Lumax to Open First China Office in 2025 as It Pivots Manufacturing with Tier 0.5 Strategy!

By Ashutosh Arora

Lumax Auto Technologies is preparing for a major strategic leap as it sets its sights on global competitiveness and deeper integration of electronics and software in automotive systems. By the end of 2025, the company will open its first office in China, a move Managing Director Anmol Jain describes as essential for staying ahead of the curve in automotive manufacturing. For Jain, China represents not just a sourcing hub, but also a window into the future. “All of what we see in China today is years ahead of not just India, but even the West,” he said.

The China office will function as a group resource centre, supporting multiple functions including sourcing, tooling, and technology scouting. Lumax already sources parts and tooling from the region, but having a direct presence will allow the company to optimize sourcing, track emerging trends in real time, and potentially sign technology licensing agreements to bring advanced solutions to the Indian market. Jain emphasized that this expansion is not a diversion from India but a reinforcement of it—feeding the company’s Indian manufacturing operations with cutting-edge global inputs.

Complementing the China strategy, Lumax is also building SHIFT (Smart Hub for Innovation and Future Technologies) in Bengaluru, a new software development centre designed to integrate electronics with vehicle system architecture. As Jain explained, manufacturing today cannot rely on hardware alone; without software integration, Lumax cannot offer modular and bundled systems to OEMs. The Bengaluru hub will bridge this gap, providing the “glue” that binds hardware and electronics into intelligent, integrated solutions.

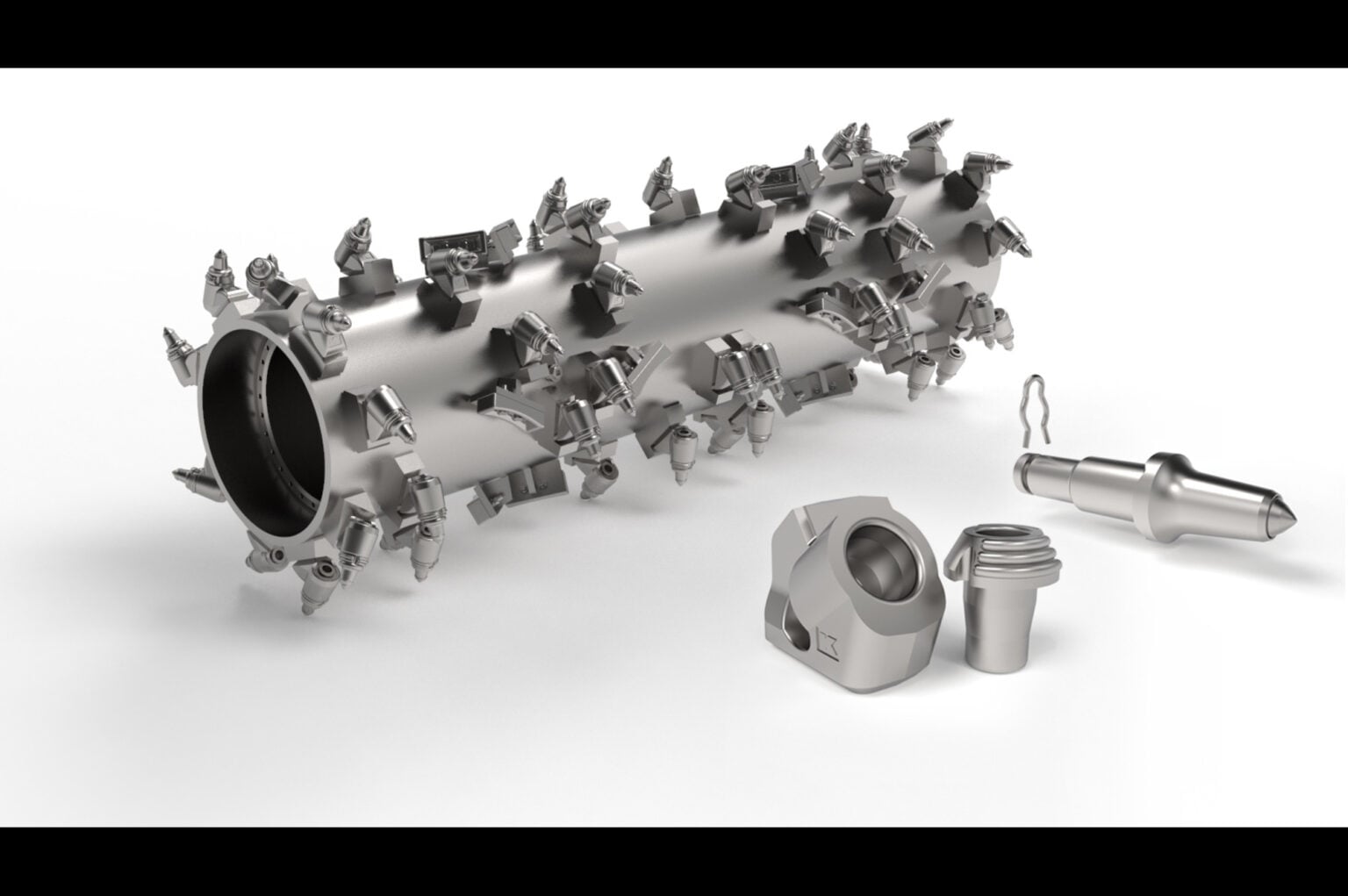

This shift underpins Lumax’s evolution from a Tier 1 supplier of components to what Jain calls a Tier 0.5 player—a systems integrator that can deliver end-to-end solutions rather than standalone parts. Instead of selling interior lighting, cockpits, or switches separately, Lumax plans to bundle them as integrated systems, working closely with OEMs from the design stage. Jain noted that much of his engineering team is already embedded within OEMs, co-creating new models in a concurrent engineering approach rather than the traditional sequential model. This deeper integration means Lumax is already engaged in projects for vehicles set to launch in 2028.

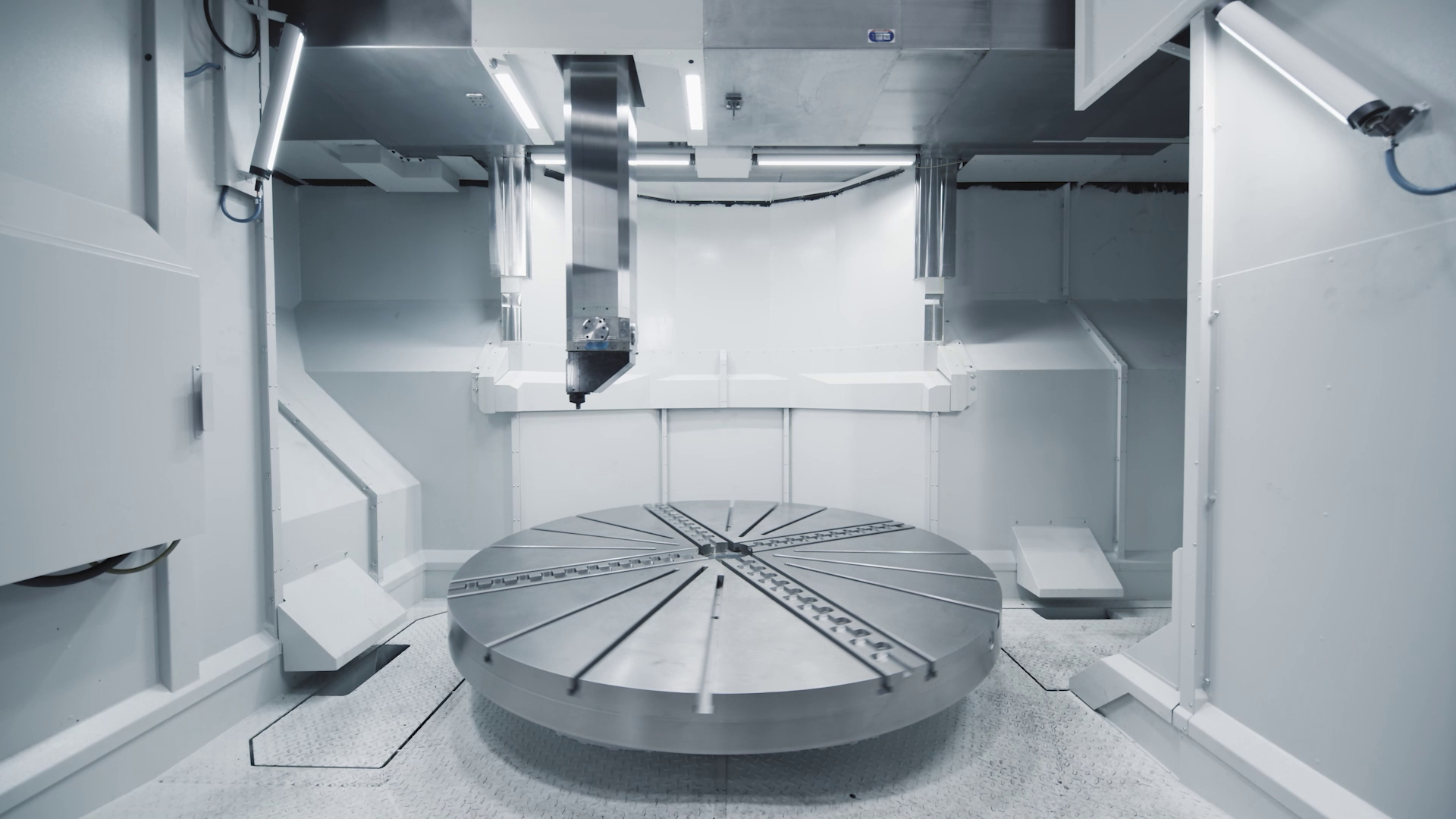

The systems approach is also transforming Lumax’s manufacturing footprint. Historically, the group operated 42 facilities, each focused on individual components. Under the new strategy, Lumax will consolidate operations into mega plants that house multiple product lines under one roof. This integration will bring economies of scale, reduce fixed costs, and enable Lumax to supply OEMs with complete systems rather than discrete products. The company’s first mega plant is expected to go live in the fourth quarter of this financial year.

Despite these bold moves, Jain acknowledges significant challenges. Chief among them is building software capability within the organization, a task that will require both new hires and retraining of existing engineers. Over time, the company’s engineering pool will shift from predominantly mechanical to a blend of electronics and software expertise. Supply chains too will evolve, with greater emphasis on sensors, electronics, and smart components. Lumax’s procurement team has already drawn up a six-year roadmap to align sourcing with this transformation.

Jain remains firmly optimistic about India’s role in Lumax’s future. “We still believe in the India story. If you are in a growing market, which you believe has that opportunity to continue to grow, you would rather climb this mountain to the fullest than start from ground zero elsewhere,” he said. With diversification across two-wheelers, four-wheelers, and commercial vehicles, and with 40 percent of its order book already tied to future mobility, Lumax is betting big on the shift toward integrated systems.

For Jain, the opportunity lies in the ability to adapt. As electronics and software permeate every part of the vehicle, from gesture controls to intelligent driver interfaces, suppliers that evolve into partners will define the future of automotive manufacturing. “The growth is not for everybody,” he concluded. “Everybody will not grow at the same proportion. But for those who adapt, the opportunity to move from supplier to partner has never been stronger.”