Mikron Group Reports Modest Growth in 2024 Despite Challenging Market Conditions

The Swiss Mikron Group has reported preliminary and unaudited net sales of CHF 374.1 million for 2024, marking a 1% increase compared to the previous year. Despite facing a difficult market environment, particularly in Europe, the Group’s two business segments—Mikron Automation and Mikron Machining Solutions—showed resilience and modest growth.

Key Financial Highlights:

- Net Sales: CHF 374.1 million, up by 1% from 2023.

- Mikron Automation: CHF 233.3 million, a 0.9% increase, driven by strong growth in Europe, but offset by a decline in the USA.

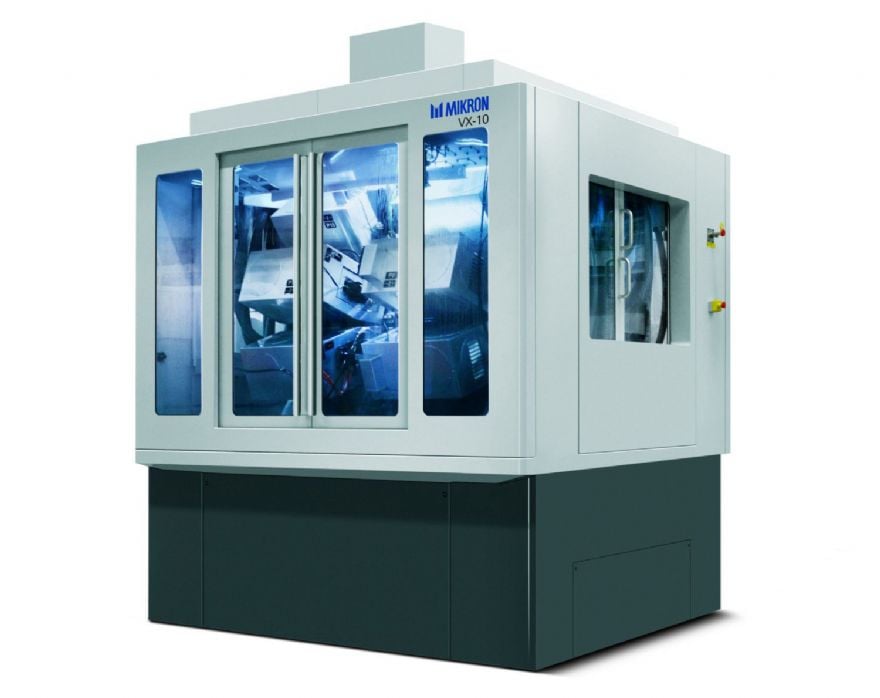

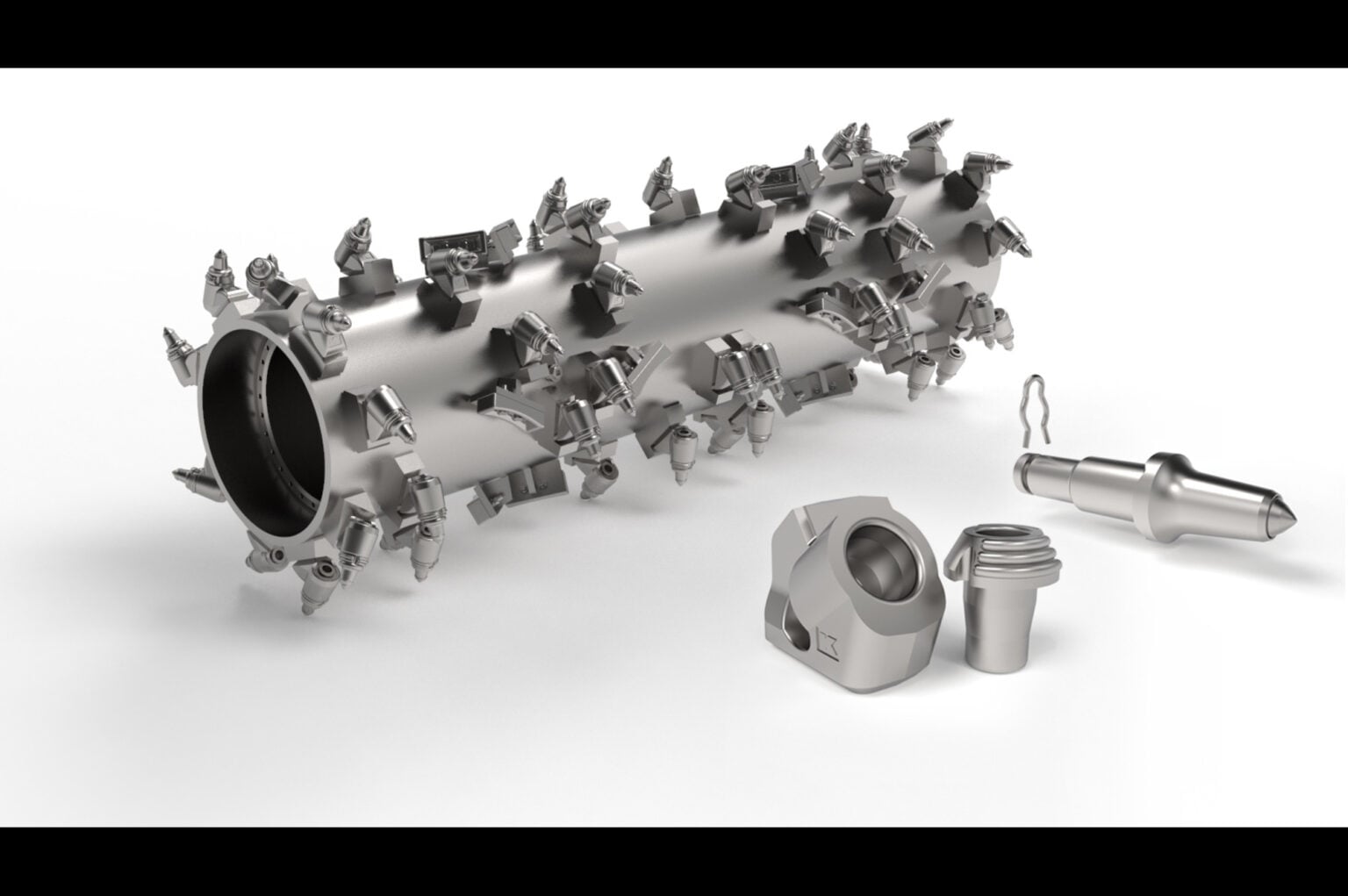

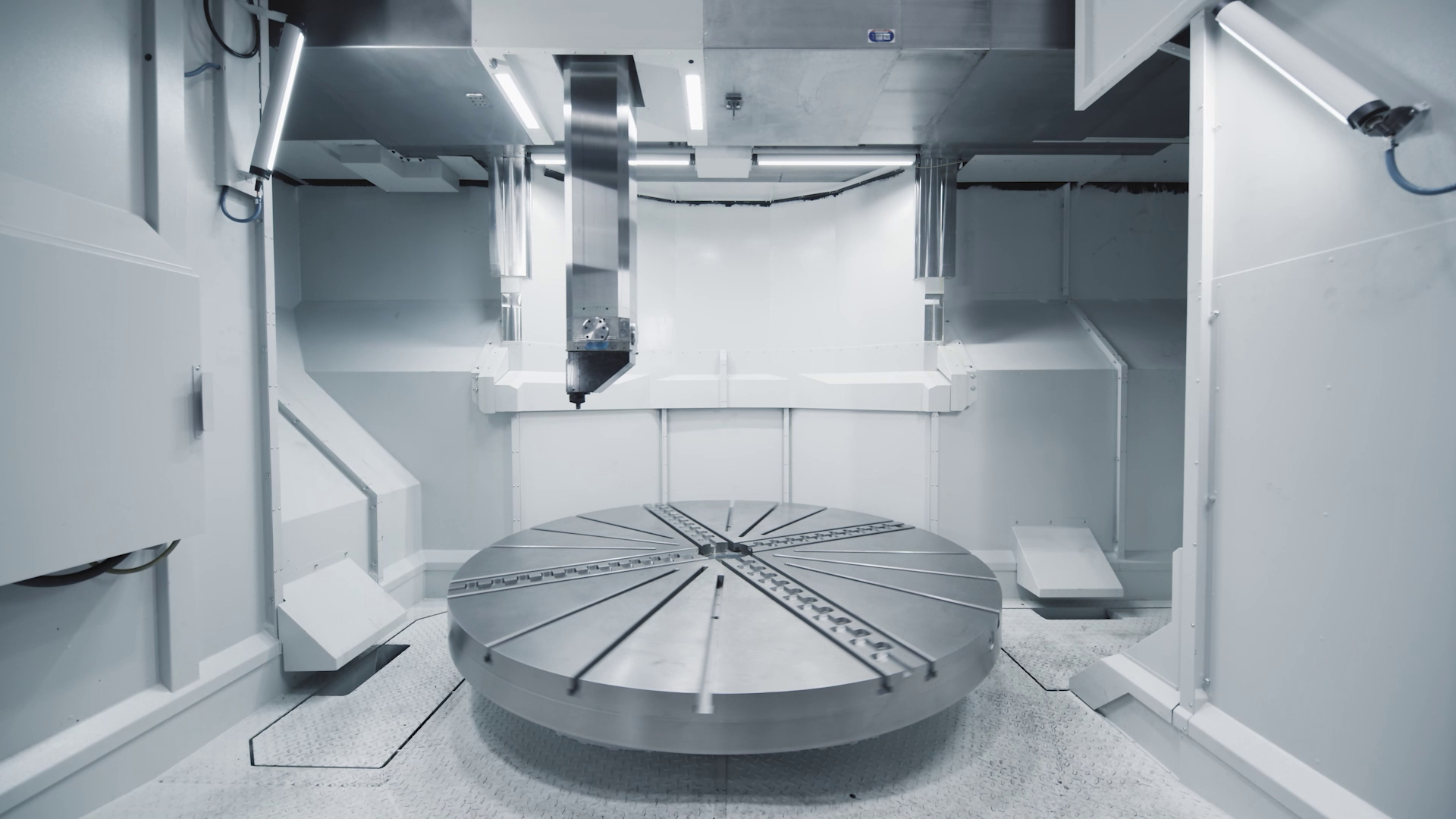

- Mikron Machining Solutions: CHF 140.8 million, a 1.2% increase, reflecting solid results despite challenging European market conditions.

- Order Intake: CHF 388.6 million, down by 5.7% from 2023.

- Automation: CHF 265 million, a 4% decline, with solid results in Europe and Asia but a drop in the USA.

- Machining Solutions: CHF 123.7 million, a 9.1% decrease, reflecting weaker market conditions in Europe, but a growing market in the USA.

Order Backlog and Outlook:

As Mikron entered 2025, it reported a healthy order backlog of CHF 324.1 million, representing an increase of 6.5% compared to the previous year. Despite the decrease in order intake, the Group’s strong order backlog indicates a solid foundation for the upcoming year.

Profit Expectations:

Mikron expects an operating profit margin of around 8.5% for 2024, a slight decrease from 9% in 2023. The detailed financial results for 2024 will be disclosed on 7 March 2025.

Conclusion:

Mikron’s ability to show growth amidst market challenges highlights its resilience and strategic focus on core markets. While order intake saw a decline, the Group’s robust order backlog and steady sales growth, particularly in Europe, provide a positive outlook for the future.