To say the automotive industry is having a challenging time is an understatement. For many suppliers, 2020 and 2021 is about getting through a lean spell and waiting for vehicle launches to materialise, while assessing how to transition to electric and low carbon vehicles. Optimism and orders are building, says Will Stirling.

In mid-August, Toyota slashed planned global production for September by 40%, or 360,000 vehicles. This would be sensational news from the world’s biggest car company, but this is pandemic-recovery time, where news is rarely shocking, and where weak demand and a global deficit of semiconductors is causing all carmakers to cut production.

Both Covid and Brexit have hit automotive suppliers hard. Grainger and Worrall (G&W) in Bridgnorth is large and diversified, with business units in prototype and production castings for engine blocks for motorsport and sports cars. While it also manufactures other engine parts, it has a machining business and makes small series components for specialist customers like Koenigsegg and McLaren. Having a large headcount, when orders dried up it was forced to cut 20% of the workforce. Today, orders are returning, but the big story is new business. “Recently, our enquiry hopper has been dominated by what we class as EV-related,” says engineering and technology director Keith Denholm. “EV is a great challenge. We are doing some fabulous things, but the next step is about applying castings that have never been done before.”

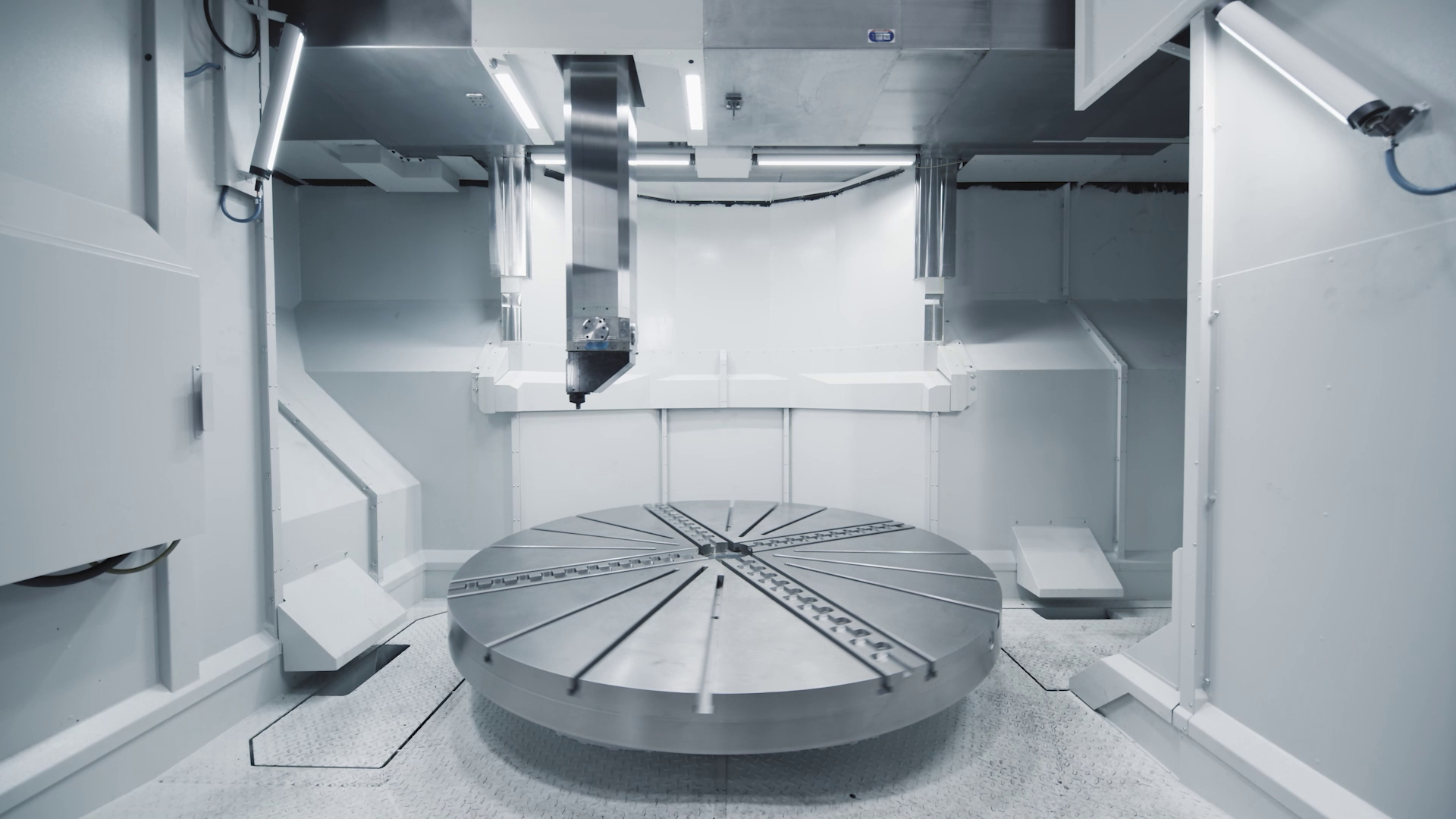

G&W is working with a leading US electric car company on many innovative projects that consolidate parts into single large castings. Think single castings the size of the rear end of a vehicle and you’re getting close. This approach is changing the thinking in the EV industry, and is driving innovation at G&W. “This is a great opportunity because time to market does not afford the luxury to wait for the production dies and factories to build representative vehicles,” says Keith. “This is now the job of the prototype, and at G&W we are sitting on a ready-made facility, both intellectually and physically, here in Bridgnorth, to actually become the incumbent for this technology,”

While the practical realities of single body castings are hard to navigate, the EV company is currently G&W’s biggest customer, indicating the potential for this new process.

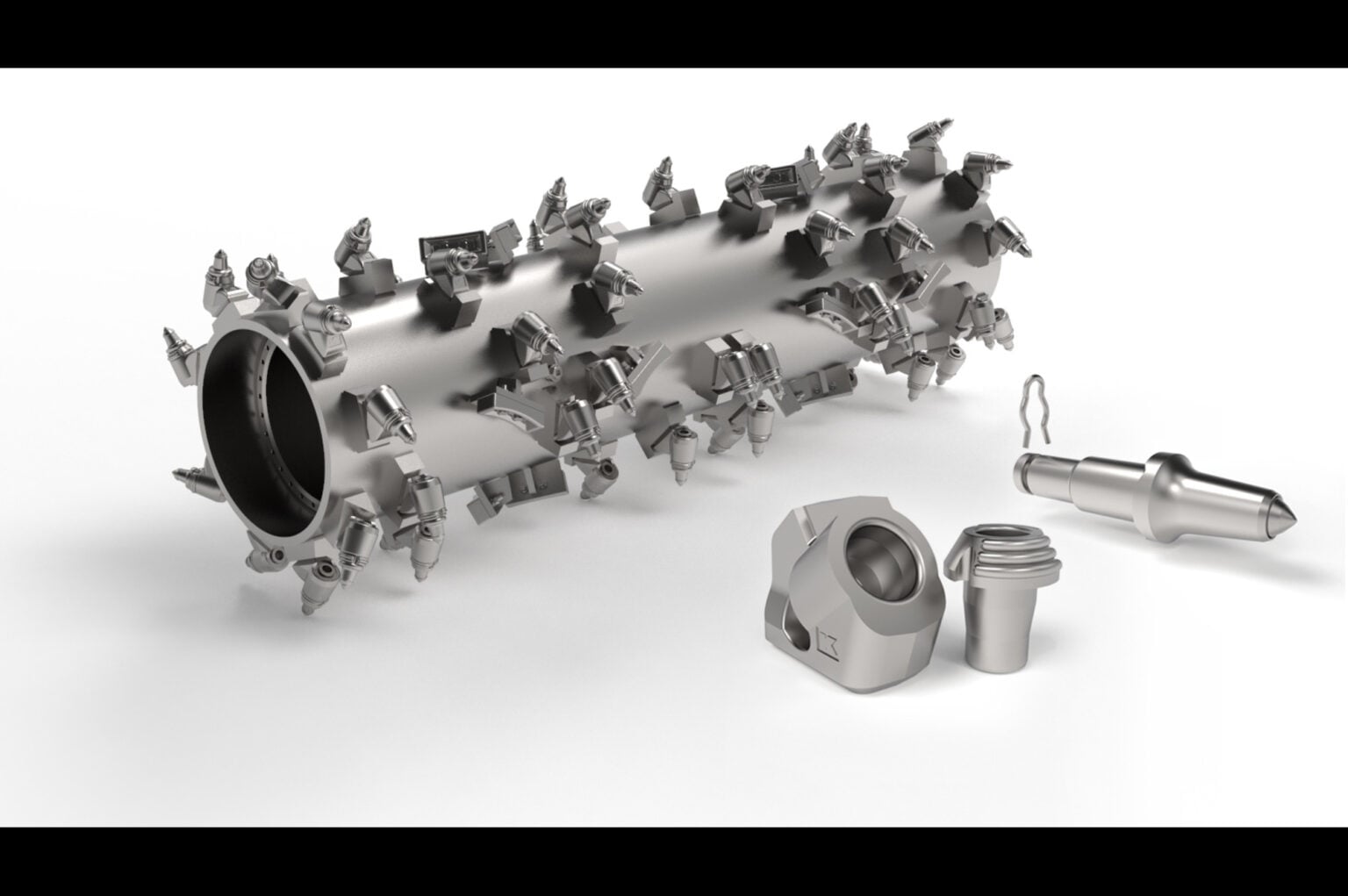

G&W has also, for many years, manufactured electric drive units, different transmission units, and in-wheel motors, which have casings that hold fluid and transfer loads, for EV and hybrid cars that Keith is confident will continue to grow. While EV manufacturing technologies develop, ICE (internal combustion engines) vehicles must bridge the gap and here Keith sees high demand for technology to help the haulage and off-road vehicle market to become Euro 6 and China 6 emissions compliant.

For managing the transition to electrification, suppliers to both lead acid and lithium batteries should be in the box seat. Entek manufactures polyethylene-based lead acid battery and lithium battery separators. In lead acid batteries, these microporous components prevent short-circuiting between the positive and negative plates. As such Entek occupies an enviable position because lead acid batteries are needed in all ICEs, and all EVs need one to power their auxiliary systems. In addition, 75%-80% of the lead acid battery market is aftermarket with just 20% sold to OEMs, so while cars are in constant use even during lockdown, batteries are still in high demand. Entek’s lead acid business was down less than 10% in 2020 and is now recovering to above 2019 levels.

“As demand for lead acid batteries potentially plateaus in decades to come, there is still a massive 1.42bn vehicle park in the world supporting replacement battery demand.” says Dr Graeme Fraser-Bell, VP of lithium sales and market development. “But then we are also on the cusp of the phenomenal growth in the EV battery supply chain.” A former Entek owner, following an MBO and retirement in 2012, Graeme was asked to re-join the company to develop Entek’s lithium battery business in worldwide.

Entek operates the UK’s only manufacturing facility for lead acid battery separators just outside Newcastle-upon-Tyne, with £50m turnover. In an exciting recent development, Entek signed an MOU with the battery-maker British Volt to co-locate the UK’s first lithium battery separator facility in Blyth. “We’re actually at the epicentre of what is becoming a North-East automotive EV cluster,” Graeme adds.

R A Labone has two UK businesses, R A Labone & Co Ltd and a subsidiary, Labone Castleside, which have different automotive sector experiences. R A Labone (RAL) makes specialised connectors and electronics housings that are mainly insert moulded, and Castleside makes trim mouldings. Pre-Covid, the combined entity had 265 employees and £26m turnover. Currently the two have 210 employees and circa £19m turnover, indicating the impact of Covid. RAL’s products include connectors for windscreen wipers and housings for tyre pressure sensors. Both companies supply tier ones that supply OEMs including Ford, BMW, Daimler, JLR and Nissan.

Looking ahead, RAL’s forecast is optimistic having a diverse customer base, including car and commercial vehicles, and it has not been severely impacted by supply chain shortages. As Castleside, Managing Director Chris Young says: “The short term is still concerning, particularly JLR where production is still well below plan, but the medium term is more positive if planned vehicle launches go to plan.” For new business, electrification is presenting some new opportunities for connectors at RAL. He says the semiconductor shortages are heavily impacting the whole supply chain but expects business to recover quickly if this bottleneck can be removed.

For new manufacturing technologies, RAL has invested heavily in automation over the past five years and expects this to continue. At Castleside, the site is planning for the introduction of cobots – collaborative robots – to reduce operator content for simple assembly/packing/checking operations.

The order book at SDE Technology, a presswork supplier that has developed technology for making lightweight parts, has returned strongly, and despite very tough conditions SDE continued to invest. As well as the impact of Covid, CCO Christopher Greenough says the supply delays from Brexit were a big challenge. “Many mills and material suppliers cut their capacity in 2020 and this is still not fully back online,” he says. “This has led to shortages, which only goes to increase prices and extend lead times, making planning, scheduling and supporting customers very difficult. It also leads to further pressure on the manufacturing sector.”

But SDE Technology sees a brighter future involving reshoring. The global impact of the pandemic has meant that many big companies are now looking closely at their supply chains, and the impact of any disruptions to production. “The semiconductor chip shortage has meant that whole [automotive] production facilities have stopped, which impacts the local supply chains and jobs. There is now a real push to reshore manufacturing, to make sure that local suppliers can pick up the capacity when needed that will drive investment.” Supported by central government investment in new battery gigafactories, Chris believes there is a bright future for automotive manufacturing.

Brandauer, a 159-year-old metal pressings and stampings specialist, has secured new opportunities in both current powertrain and electrification after investing heavily in new technology and leveraging partnerships with universities.

One new application for ICEs are low tech retention clips for use on the valve train, which has involved retooling the component to high-speed progression tooling. This has improved material utilisation and reduced the stamping costs leading to two further orders for different variants of similar parts.

One new application for ICEs are low tech retention clips for use on the valve train, which has involved retooling the component to high-speed progression tooling. This has improved material utilisation and reduced the stamping costs leading to two further orders for different variants of similar parts.

CEO Rowan Crozier says: “Electrification is a big growth area that we are very excited about. We are currently involved in three Innovate UK R&D projects, all in the EV motor arena, working with companies including Jaguar Land Rover, Ricardo and Saietta. This is creating a massive amount of learning and knowledge that we can apply to other sectors. One example is producing motor laminations for drive units that are integral for the transportation of goods around factories and warehouses.”

Footnote: With thanks to the Advanced Propulsion Centre for some introductions. APC is running programmes to help automotive suppliers pivot into EV and ‘net-zero’ vehicle markets, visit www.apcuk.co.uk/ for more info.