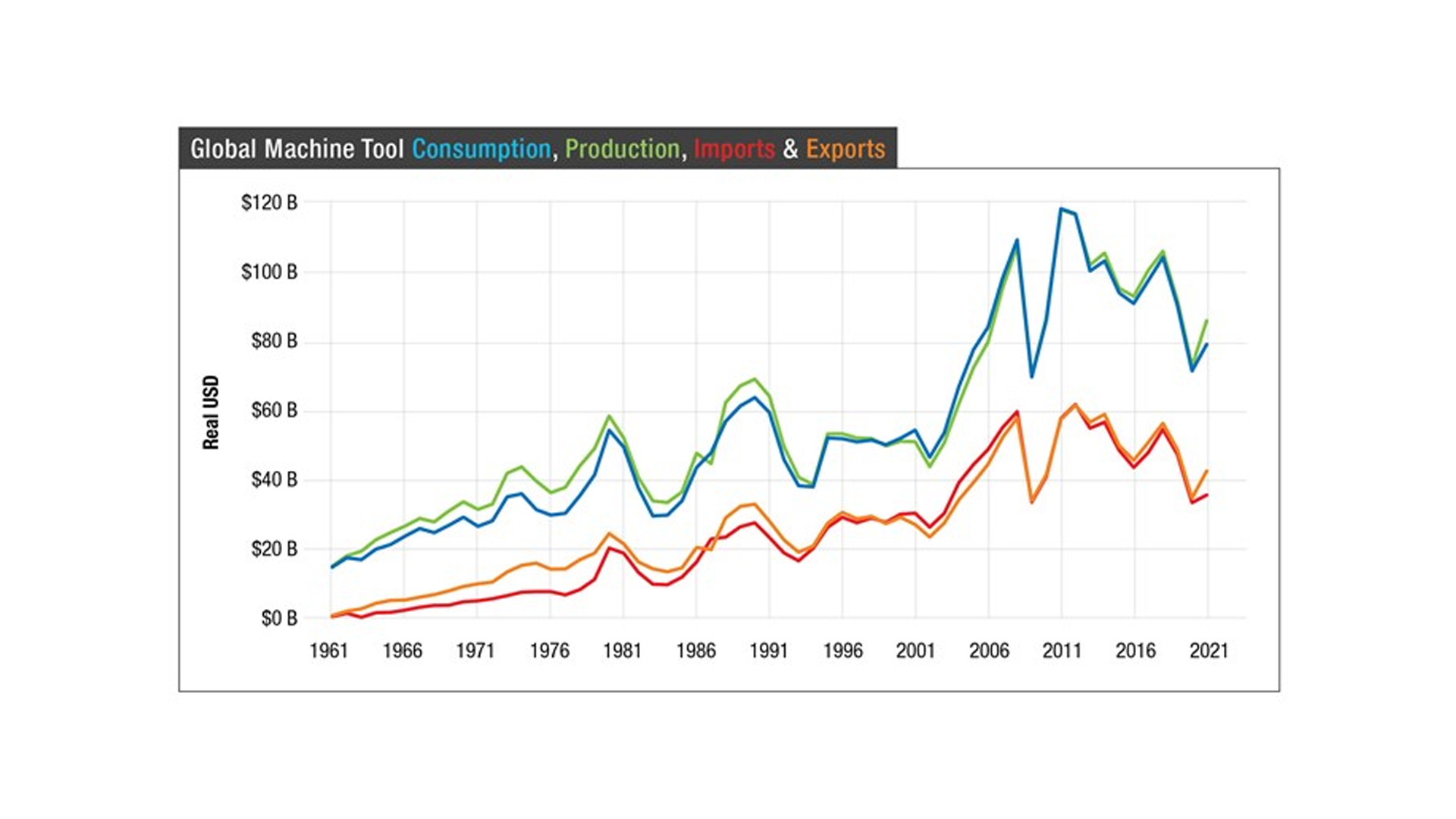

As the world recovers from what we all hope to be the worst of the COVID-19 pandemic, the latest World Machine Tool Survey (WMTS) shows the promise of an economic rebound. While the machine tool industry has not yet fully recovered from the impacts of the pandemic, it has grown across all four areas measured by the WMTS: production, consumption, imports and exports. Overall machine tool consumption has increased from $68 billion in 2020 to $80 billion in 2021, with production surging from $68 billion to $86 billion.

However, machine tool consumption is still registering below the numbers of 2010, and the recovery is likely hampered by global supply chain disruptions.

Additionally, while the six largest producers of machine tools remain unchanged, their relative positions have shifted. Italy has regained its position as the fourth-largest producer and consumer of machine tools, pushing the U.S. to fifth place. Meanwhile, Japan has unseated Germany as the largest exporter of machine tools.

One of the biggest stories, however, is China’s recovery. Unlike every other top-six machine tool producing country, China has exceeded its 2018 numbers in both production and consumption of machine tools. This raises the question: Why is China the only country to have fully recovered from the 2020 downturn?

Last year, we compared the 2020 downturn in the machine tool market to conditions in 2009, when the market collapsed under the weight of the Great Recession. Therefore, it may be worthwhile to compare the 2021 data to that of 2010.

In that year, production of machine tools (measured in real dollars) rebounded in a similar manner. However, numerous countries, such as Germany and the United States, saw a year-over-year decline in 2010 machine tool production while other nations made up the difference.

In 2021, by contrast, nearly every nation accounted for in the data saw a year-over-year increase in machine tool production. The fact that this coincides with relatively restrained growth in consumption compared to pre-pandemic levels makes it likely that the ongoing consequences of the pandemic — both in the loss of life and disruption to the global supply chain — are restraining the machine tool industry’s ability to recover from 2020.

In fact, global production exceeds consumption by nearly $6 billion, far more than in recent years. This difference may be due to attempts by machine tool builders to avoid supply chain disruptions, and it may put downward pressure on the prices of machine tools. Of course, the disruptions in the global supply chain likely put upward pressure on machine tool prices, but the extent to which these will balance out is currently unforeseeable.

Overall, the WMTS indicates that the industry is recovering, but not as quickly as it might without the supply chain turmoil. Of all the countries in the survey, China is the only one to surpass 2019 machine tool production levels.

Chinese Production Fuels Chinese Consumption

Although the rest of the world has been recovering gradually, Chinese consumption has surged past its 2019 level, surpassing $33 billion. The consumption was fueled largely by domestic production, which surged to more than $31 billion, well beyond 2018’s $26 billion benchmark. It is worth examining why this is.

This response presaged the global response to COVID-caused supply chain disruptions, which is characterized by near-shoring and reshoring critical stages of production.

It is likely this strengthening of the domestic manufacturing sector has perfectly positioned China to rebound from the pandemic, as we are seeing in its machine tool production. Further, while China’s production has dramatically increased, its total exports fell slightly. This again suggests that China’s production is largely fueled by domestic consumption.