🎧Incentives needed to ease bumpy ride along Electric Avenue

The electrification transition and inflexible EV production quotas are taking a heavy toll on the automotive industry, but buses and commercial vehicles posted their best years since 2008. Will Stirling reports.

MTD magazine is unwaveringly positive in its coverage of manufacturing news, but facts are facts: automotive manufacturing is on a downward slide. Combining cars and commercial vehicles (CVs), the UK produced 905,233 units in 2024, -11.8% from 2023, and slipping below the psychologically important one million units mark. Electric vehicles now comprise over one-fifth of all new car registrations, but the EV market contracted by 2.5% to 139,345 units. The bright spots are in the commercial vehicle (CV) and bus markets. Production in the UK rose 4% to 125,649 units, and both buses and CVs have had their best years since 2008.

Carmakers face a multitude of challenges to produce both ICE (combustion engine) and EV cars in high volume. Higher energy and material costs, shortage of skilled people and potential tariffs on exports to the US, but the two most significant factors affecting the production of cars are the costly transition to electric and globally softer demand. The government has set onerous targets for the proportion of EVs that car companies make in Britain, from 22% last year to 28% this year – a tall order that experts believe won’t happen – and 80% by 2030, after which the ICE car ban kicks in. The problem is that these targets are running ahead of demand.

“The targets were set when demand forecasts were much higher; we know there’ll be a significant shortfall,” says Professor David Bailey, an automotive business expert at the University of Birmingham. “Car firms are going to struggle to shift that volume of cars without very significant discounting, and therefore losses.”

He adds: “Our two biggest producers, Nissan and Jaguar Land Rover, will struggle to meet that kind of stretched targets as they get bigger, so they will potentially be fined, and they may well have to buy credits from Chinese all-EV makers who can hit the target. So what a perverse policy that is – that you’re subsidising the Chinese and fining domestic manufacturers.”

Electric vehicle production and net zero targets have not been intelligently assessed. The government intends to phase out new petrol and diesel cars by 2030, and although the car industry was invited to consult on this in December 2024, many think the target is too early to hit.

“The 2030 ban on ICE policy was plucked out of thin air to try to differentiate the UK from the European Union while signalling to investors that the UK is serious about decarbonisation to encourage investment in the UK. But it hasn’t worked – because Brexit has made the UK less competitive and attractive, because of high energy costs, and it hasn’t worked because we don’t have a proper industrial strategy to support that transition,” David says. The government is now consulting on the industrial strategy, but it should have been firmly embedded in 2025 to help hit the 2030 ICE ban effectively.

Stimulate demand; cost of electrification bites

Demand for electric vehicles needs to be higher. The government has proposed cheap loans for EVs, but it sounds too complicated for the average car buyer, who wants to know the price, not a complex subsidy and loan. And a VAT break on EVs has been proposed, although this is a pro-tax government. “The government’s problem is that it has boxed itself in agreeing to continue the fiscal rules that the Conservatives put in place, which I think was a bad mistake all along, and that has limited their room for manoeuvre. The industry wants a fiscal incentive for EVs, which could either be an upfront discount if you buy one or a VAT reduction on purchases and charging, to stimulate demand,” Bailey says.

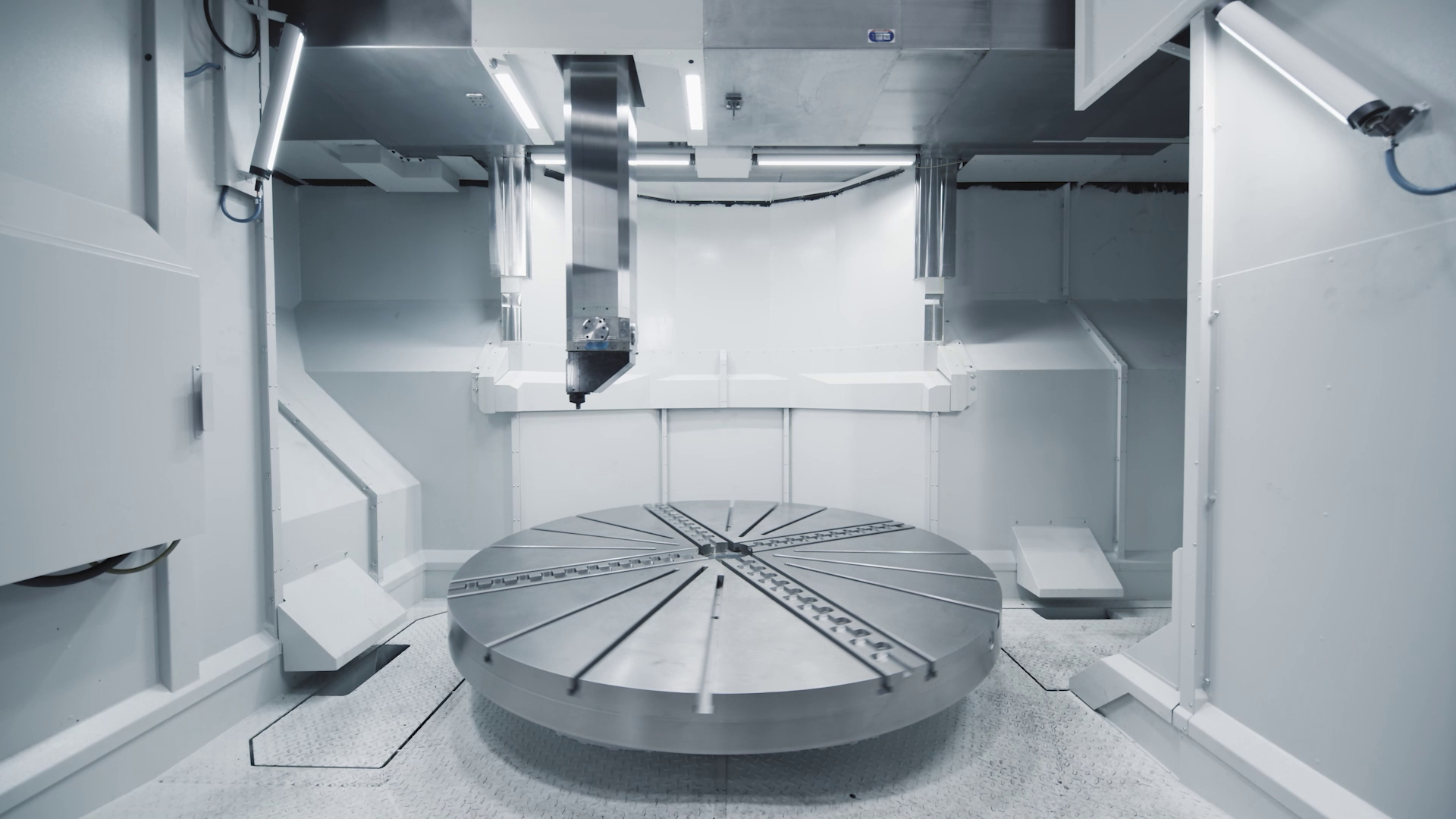

Demand for vehicles aside, car production volumes are also lower because factories spend millions of pounds and months retooling their lines for EV manufacture, affecting their ability to produce.

Internalisation of component manufacturing

Some tier one and smaller suppliers to UK automotive have gone, due partly to the complications and costs of Brexit. GKN Automotive moved its Birmingham factory capacity to Poland in 2021/2022. A lot of smaller companies have been cut out of European supply chains post-Brexit, and several auto suppliers have struggled or gone out of business, unable to cope with the export and reimport bureaucracy when some components may cross the English Channel several times before being assembled here.

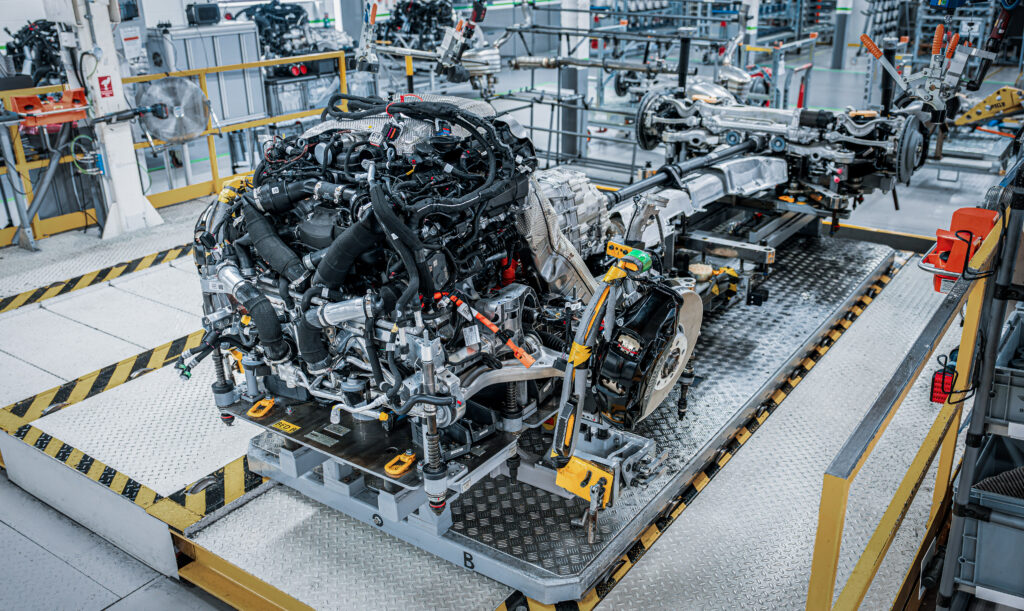

In addition, several big carmakers are internalising the manufacture of key components as these companies aim to be more vertically integrated. “Partly, this is in reaction to the semiconductor crisis where firms were caught out,” says David Bailey. “For example, Jaguar Land Rover will be making its new electric drive train in-house, probably at the i54 plant. Previously, for internal combustion engine cars, JLR would have bought the drives from GKN Driveline, but it is internalising it. We are seeing that shift broadly as well.”

A good example is Nissan’s partnership with battery company AESC, which supplies directly to Sunderland. This year, Nissan is expected to open a new 360m long, 23x football pitch-sized battery gigafactory in Sunderland. When operational, it will employ over 1,000 people and deliver a sixfold increase in UK electric vehicle battery production. The plant is basically an extension of Nissan’s car factory, a tier-one supplier part-owned by Nissan right next door.

Pay attention, subbies: Bus bonanza

Deliveries of new buses, coaches and minibuses reached a 16-year high in 2024, with 8,390 new units hitting the UK’s roads (total buses produced were higher due to healthy exports). Demand rose across the three main segments: minibuses, single-deckers and double-deckers, with minibuses posting 102.5% year-on-year growth. Zero emission is the main story in buses, and the UK is still Europe’s biggest zero-emission bus market, with deliveries up by more than a third in 2024.

As of 2023, Ballymena-based bus manufacturer Wrightbus reported a turnover of £283.4m, a significant 71% increase from £163.3m in 2022. Despite this, profits in 2023 were negative, probably reflecting the big investment in transitioning to net zero powertrains and new tooling. Wrightbus exemplifies the switch to zero emissions. “Alongside our market-leading EV bus, 95% of all buses produced by Wrightbus in Ballymena are now zero emissions – a marked change on 2019, when 95% of all orders were for diesels,” said Jean-Marc Gales, CEO of Wrightbus, when unveiling the new Streetdeck Hydroliner Gen 2.0 hydrogen-powered bus on 20 February.

Wrightbus says production will increase to 1,200 this year and then again to 1,400 in 2026 – a record in the company’s proud history of bus manufacture. Dozens of suppliers from across the UK and Europe visited the Wrightbus factory in February to hear how the firm’s continued growth will act as a shot in the arm for the manufacturing sector, with the expected creation of up to 1,000 new supply chain jobs in the next two years.

When will car making recover?

Industry body The Society of Motor Manufacturers and Traders forecasts vehicle production to fall further in 2025 (cars and light vans to 839,000 units in 2025). Still, it adds that while the EV transition is affecting production, this will be temporary. While the volumes of all electrified technology cars were down 20.4% in 2023, with more than £20 billion worth of investment announced in 2023 and a further £3.5 billion in 2024 to support the UK’s transition, the decline will be temporary; the SMMT stated in February. Car and light van output will increase to circa 930,000 units by 2027, it says.

However, potential tariffs from the US are a real threat (second biggest UK car export market), and the lingering cost of living crisis affects EV sales. “Charging at home overnight is cheap but can be 10 times the cost at some public charging points. Plus there is 20 percent VAT at a charging point, but just five percent at home – so the one third of people who have no ability to charge at home will struggle with the transition,” says David Bailey. And while the Dept for Transport has said it is on track to install the target 300,000 charging points by 2030, many people have range and charging speed anxiety, so much more PR is needed to persuade a cash-strapped, conservative public to go electric.