Reviewing the state of play in late 2022 and looking ahead, companies that manufacture goods in the UK will be writing a very long Christmas list. Political and fiscal stability, yes, plus lower energy costs, lower inflation, control of interest rates, access to workers, and more orders. Above all, though, they need faster delivery times of parts. Will Stirling reports.

MTD’s content is unashamedly positive in its promotion of manufacturing. But it is difficult to be exclusively positive when reviewing the sector in 2022 and looking immediately ahead. Barclays’ weekly newsletter on the sector, in October, says recent ONS data shows turnover in the manufacturing sector decreased by 9.2% in 2022, from £636bn to £577bn, while the number of people employed in manufacturing decreased by 1.7%, compared to the previous year.

It adds that the total number of manufacturing businesses has fallen from 270,000 at the start of 2021 to 244,140 in 2022. The decrease in the number of companies can be attributed to falling orders in an economic slowdown, with output falling for the third month in a row, and orders declining for a fourth consecutive month in September 2022.

Companies are under intense pressure – a phrase that is becoming a cliché – from multiple forces. Supply shortages, a doubling of energy costs, raw material inflation, and the low availability and ‘stickiness’ of skilled employees. Energy costs alone are a serious issue but energy-intensive businesses like steelmaking have access to special energy cost support from the government. Pay levels are under immense pressure because of high inflation and unions are taking industrial action every week. It is tough out there.

Despite the newsreel of difficulties, positives include substantial tax relief on capital equipment purchases, a recovery in aerospace orders, electrification opportunities and regular news of factory investment. Tevva Trucks has opened a new factory in Tilbury to manufacture electric trucks, Stellantis’ Luton plant has manufactured the first FIAT van in the UK, Guala Closures is investing £36m in a super-factory in Lanarkshire and KLA Corporation, a US manufacturer of electronics equipment, plans to build a new R&D and manufacturing centre in Newport, Wales. Battery manufacture capacity, such as a potential new factory by Taiwan’s ProLogium, is growing constantly there are many more anecdotal stories of factory investment.

But choosing the UK as the preferred location for big new factories of global companies that employ hundreds of workers is, at the moment, a very tough sell. Weeks of political discord, the falling pound and costly borrowing rates for government bonds have eroded the UK’s international reputation. Even with a new prime minister with Chancellor experience, it will take a mighty effort to restore this in a medium-term timescale.

Cries of ‘We cannot get the parts’ ring out across the land

Give us the tools, and we will finish the job. Politics aside, the biggest factor influencing manufacturing is the shortage of key components. Born of the Covid pandemic, huge demand bottlenecks for semiconductors or chips and the electronics they are found in needed to build cars, aircraft, white goods and machine tools are still unwinding and look set to continue. PP Control & Automation needs products like PLC controllers to build its range of power control units. “2022 has been a challenging year for many manufacturers in controls & automation, albeit order books among UK-based OEMs are strong and demand is maintaining,” says CEO, Tony Hague. “The overriding negative has been the availability of parts, with lead times once estimated for 1-2 weeks now turning into 18-24 months. That is the scale of the problem, driven by the scarcity of micro-electronics.” Tony is positive about suppliers’ ability to grow in 2023, but this gross delay in parts is an existential problem that will simply thwart the potential for growth.

Because semiconductors are found in everything from a vacuum cleaner to an Xbox, when Covid annihilated ‘semcon’ supplied from Taiwan, Korea and China, every manufacturing segment caught a cold. Machinery builders, MTD’s sweet spot, have been heavily affected. “Constraints in delivering machines come from the problem in getting electronic components (mainly for controls); the problems this caused for the automotive industry is well known but it equally applies to machinery suppliers, including machine tools,” says statistician at the MTA, Geoff Noon. “In our Business Survey, discounting the number one answer about constraints on activity which is always ‘lack of orders’, in both the first and second quarters of 2022, the most commonly reported constraint (and not just from machinery companies) was ‘delivery from suppliers. Early signs for the Q3 survey are that while this may have slipped back, it remains a significant problem.”

Substantial tax relief is working

To counteract, if not precisely, pressures from supply shortages and inflation, machinery buyers now have generous capital allowances to reduce their tax bill. Firstly, companies had the Annual Investment Allowance to write down capital spending against tax, then from April 2021 to March 2023, the Super Deduction scheme offers 130% first-year relief on qualifying main rate plant and machinery investments until 31 March 2023. The Treasury introduced this because existing low levels of business investment have fallen further since the pandemic, reducing by 11.6% between Q3 2019 and Q3 2020.

Geoff Noon says: “We believe the super deduction had a positive impact on capital spending although it is hard to see in the data yet because machinery and related software is a relatively small part of the overall investment data in which analysts look for the impact. In our survey of visitors at MACH, 58% said that they had increased their investment plans for the coming 12 months as a result of the super deduction scheme (broadly the period to the end of the

scheme) and 39% said that the enhanced Annual Investment Allowance (temporary extension to £1m at the time but recently announced by the Chancellor to be permanent) had boosted their plans.”

The MTA also say that changes in the automotive industry are affecting the machine tool industry profoundly. Honda has closed its plant, automotive output suffered terribly during Covid and while retail sales at Jaguar Land Rover are up by 88,121 by 30 September (a 9.3% increase on the previous quarter) and there is some recovery, volumes are struggling in 2022 as cars transition to electric.

“The move to electric/hybrid vehicles is an issue for the machine tool industry, especially where the UK makes more IC engines than we do cars,” says Noon. “Recent studies in Europe suggest that compared to a conventional car, a hybrid vehicle needs 105% of the machine tools in its manufacture but a pure battery-driven vehicle needs only about 60% of the machine tools. We have probably seen the last major investment in new internal combustion engine facilities (there will be some replacement spending in the next few years) which will limit the growth in machine tool demand even in the short-term.”

On the plus side Arrival, along with Tevva the UK’s newest vehicle manufacturer at scale, has produced its first production verification vehicle from its micro factory in Bicester, finished its first batch of vans for road testing in September.

Aerospace recovery gaining speed, plus 2023 outlook

After a punishing two and half years, civil aerospace is beginning to recover, order books for Airbus and Boeing are growing and some companies have a near-plump pipeline of orders. ADS, the aerospace trade body, says that in April 2022 aircraft orders collapsed by 40% from their 2019 highs, and ADS’ latest figures showed this had improved by only 2% since 2022. But head of communications Alexander Hamilton says many signs are positive. “Firstly, deliveries have picked up, which is a good sign of both demand and manufacturing capacity. Flight numbers from and to the UK are just 15%, in Europe 12%, down on pre-pandemic levels, so while lower, this is well up on where it was 12-months ago. Long-term production rate forecasts from Airbus and Boeing are strong, with both looking to ramp production up to pre-pandemic levels – to about 64 aircraft per month for Airbus – in the next two years.”

This ramp-up will pass on to suppliers and ADS expects an end-of-year push in aerospace production. If there has been a move in the complexion of what aerospace companies make in the UK, there has been a strong emphasis on more composite structures, R&D and manufacture, in recent years. “There is more investment in R&D in composites, thermoplastics and testing now. The Wing of Tomorrow programme covers some of this,” says Aimie Stone, ADS’ senior economist.

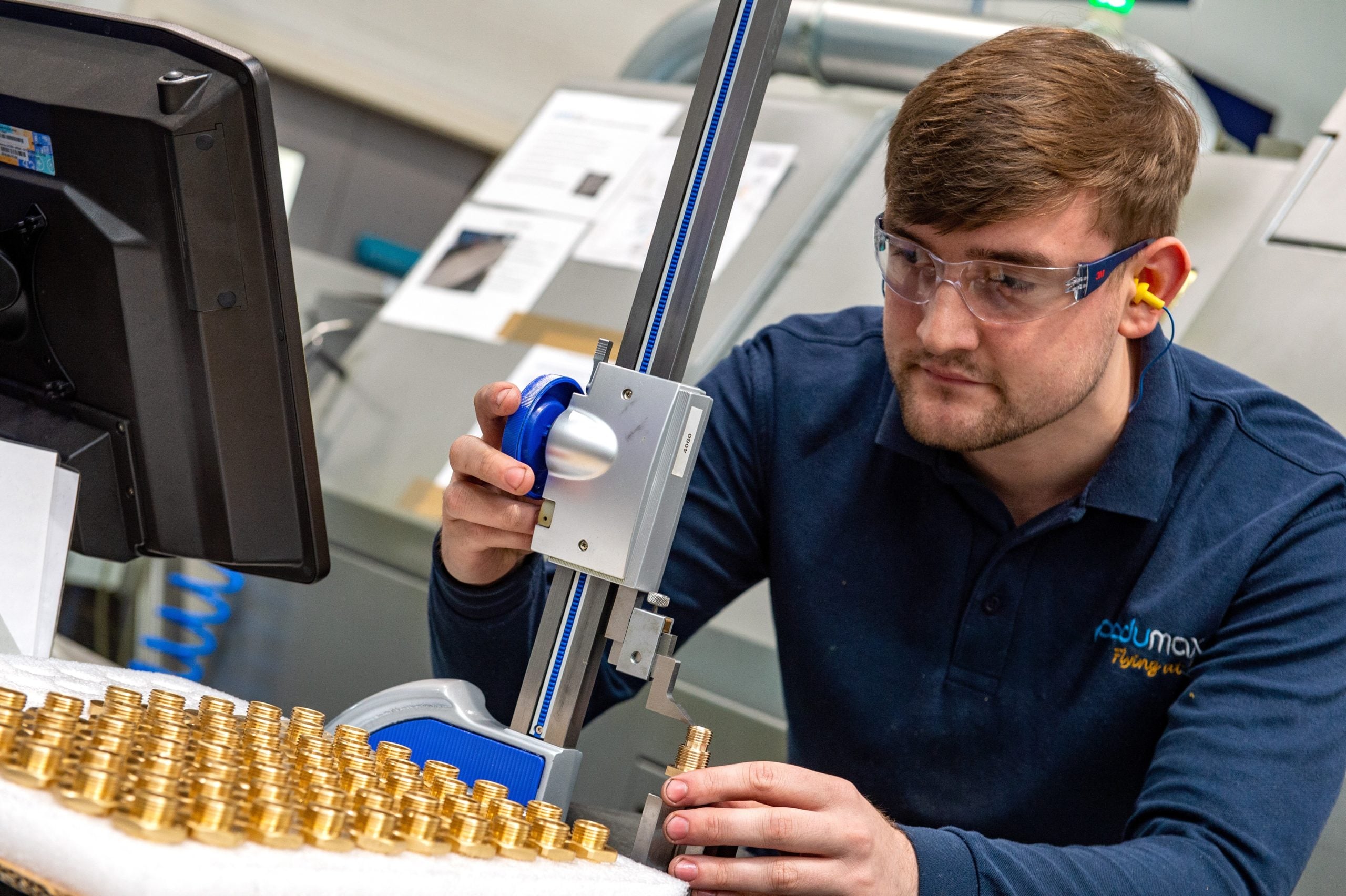

SMEs are often the bellwether for sector health as orders trickle down the supply chain, and Produmax in Shipley is a good example. The company specialises in the design and manufacture of flight control components. Some diversification has been key. “During the pandemic, we have onboarded about 10 blue chip customers, within and outside civil aerospace,” Finance Director Mandy Ridyard says. “We’ve diversified into more countries, companies and platforms – obviously a heavy shift into narrow-body aircraft. The pandemic democratised locations: as no suppliers could visit OEMs and tier ones, it became easier for you to visit them cold – distance became no barrier with covid. We became more successful at engaging with new customers.”

The pandemic hit all aerospace companies hard, but Mandy says now Produmax is seeing growth – not in the volumes they wanted in 2022, but now at a pace, they never would have expected. “Next year our turnover will be greater than pre-pandemic; 15%-20% bigger in 2023 than this year, and thereafter almost double our size pre-pandemic. Necessity has been the mother of invention.”

There are many challenges manufacturing firms must handle, fix, solve or fudge in 2023, but most of them have been here before. Political stability, control of interest rates and improving the flow of critical components are three must-haves. “Looking ahead into 2023 and assuming we avoid a global economic meltdown and full-blown recession, UK manufacturing, with its incredible resilience and innovative nature is still well positioned for growth,” says PP C&A’s Tony Hague. “The automation space has guaranteed growth. Automation is needed to reduce our reliance on labour availability, reduce energy consumption, reduce overall manufacturing costs, and drive increased productivity.”