🎧Costs dominate 2025, as smart suppliers look to defence and electrification

🎧Costs dominate 2025, as smart suppliers look to defence and electrification

Will Stirling reviews a brittle year for manufacturing, where upbeat headline news and higher defence spending failed to offset the low-growth trap.

It has been a tough, transitional year for manufacturing, continuing a tedious trend: absurdly high energy costs, high business costs, muted investment, and stagnating growth. In sectors like aerospace, defence, battery production, and MEP for big infrastructure projects, there is a lot of work out there, and more on its way, but legacy industries like steel production and ICE automotive are having a torrid time. Outside the aerospace and defence sector, perhaps, many firms need a vision around which to plan for real growth, but instead are shackled to weak global demand.

But as Chancellor Rachel Reeves is learning, growth is hard to come by. The new Industrial Strategy was launched this year, but it will take time to filter into meaningful contracts for subcontractors, and it needs to stay the course and be accountable.

Between 1 June 2024 and 31 May 2025, one in every 189 companies on the Companies House register entered insolvency, equivalent to 53 per 10,000 companies. This is down from 55.6 per 10,000 in the year ending May 2024. Manufacturing insolvencies were 1,974 in the year to May 2025. These numbers are way off the 2008 financial crisis highs (113/10,000), but still disturbingly high.

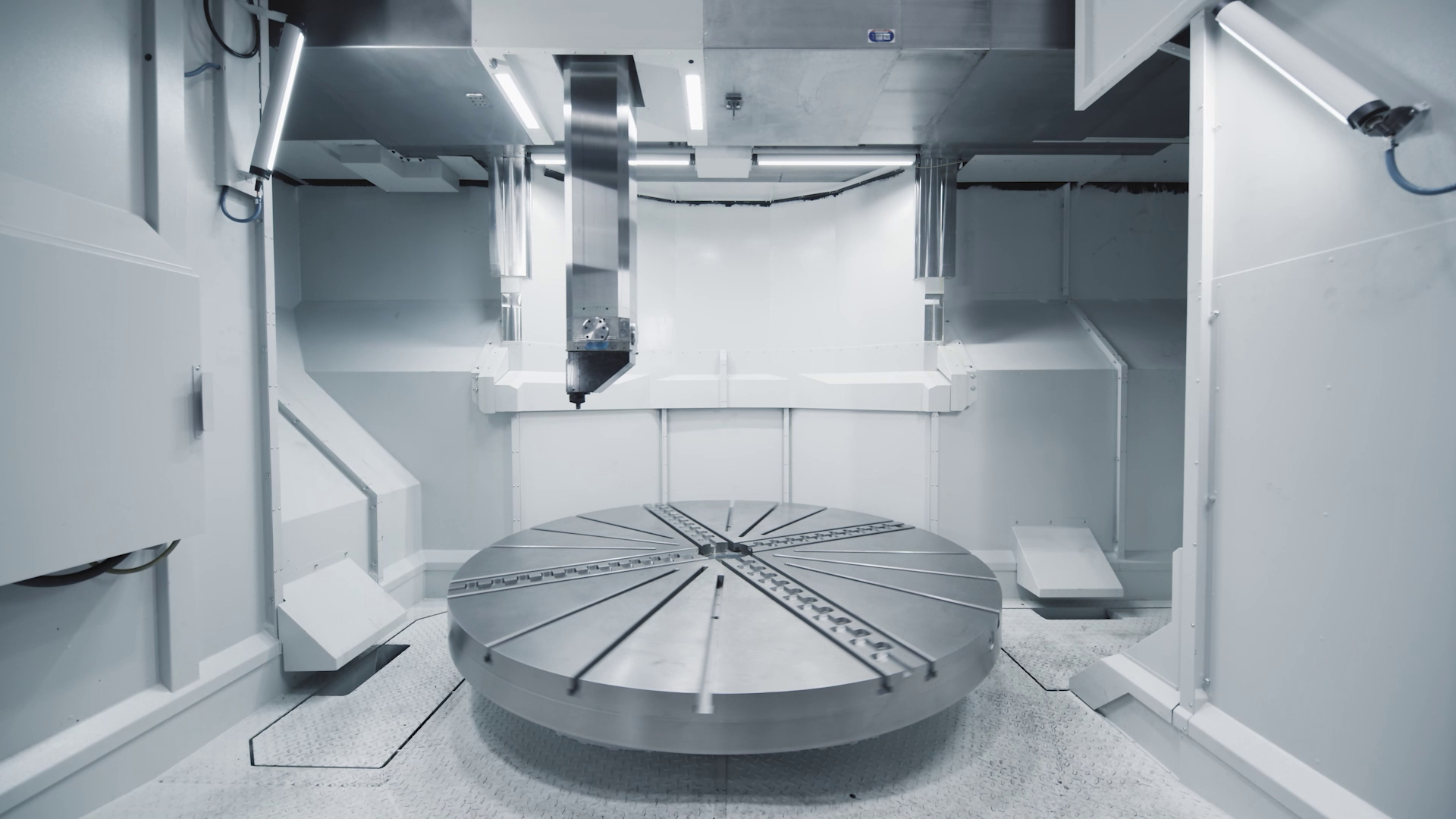

For growth in the machine tool industry, the Manufacturing Technologies Association says: “We expect the machine tool market to shrink by -11% this year before rebounding with +5% growth in 2026, while the cutting tool market is expected to remain largely flat, with a -1% decline in 2025 followed by +1% growth in 2026.” 11% is a big fall – in normal times, this might be a shock, but many engineering firms will not be surprised. Anecdotally, manufacturing technology firms report busy times for aftermarket and maintenance, and less appetite for brand new machines – as ever, there are many exceptions.

Big news stories offer many positives

The Government took control of British Steel in March. There is a global oversupply of steel, pushing prices down, making it very difficult for higher-cost British steel producers to compete. Some of the numbers make hard reading; Tata Steel in Port Talbot turned off its blast furnace in September 2024, citing losses of £1.7m a day. But steel is transitioning to green, and in July work began on Port Talbot’s new electric arc furnace, part of a £1.25bn transformation funded partly by a £500m government grant. High energy costs are at the heart of steel’s woes, with UK industrial electricity prices the highest in Europe. For large and very large users, UK prices are 132% and 113% respectively higher than the EU14 median – an absurd situation causing demands to reform the energy market.

The UK defence industry is gearing for growth. In February, the Prime Minister announced that defence spending will increase to 2.5% of GDP by 2027 and 3% in the next parliament. With GDP forecast to be c. £2.98trn in 2025, the rise to 2.5% represents about £3bn in additional spending. Defence contracts are procured internationally, but there is typically high UK content, so much of this value will filter down to UK subcontractors. In August, the Norwegian navy agreed a £10bn deal with BAE Systems to supply at least five anti-submarine Type 26 frigates, the biggest UK warship deal by export value in history. The government said the deal will support 4,000 jobs, more than 2,000 at BAE Systems’ Glasgow shipyards. The defence bonanza keeps giving, as in late October Turkey placed an £8bn deal for up to 20 Typhoon jets, where about 37% of the aircraft value is made in the UK.

The government granted final approval for Sizewell C this year – the first major British-owned nuclear power station in 30 years. The Ministry of Defence increased its recapitalisation package for Sheffield Forgemasters to £1.3bn, enabling it to install an extraordinary 13,000-tonne press. Additionally, there was a wave of factory investments in the mid-range sector: auto parts maker Astemo (£100m), Arla Foods (£179m), Norton Motorcycles (£250m), JCB’s £100m upgrade to celebrate its 80th anniversary, Etex (£170m), and Wrightbus (£150m finance package), each investing over £100m in UK factories.

Dire year for automotive, but brighter horizons

The UK automotive industry is enduring a low volume crisis.

Overall vehicle manufacturing declined markedly, dropping 12% year-on-year in the first half of 2025 to 417,232 units, with car production down 7.3% and commercial vehicle production down a whopping 45.4 %, says Professor David Bailey at Birmingham Business School.

He says this was the worst non-COVID performance since 1953 (yes, you read that correctly). The export orientation of UK car manufacturing has added to the pressure; given that the bulk of UK-built vehicles go abroad, weakness in global demand, supply chain frictions and trade issues have hit hard. One key destabiliser is intense trade and tariff uncertainty, especially from the US, which is a major market for UK auto exports. Tariffs of 10% there and a quota mean that British-made cars face higher costs and risks.

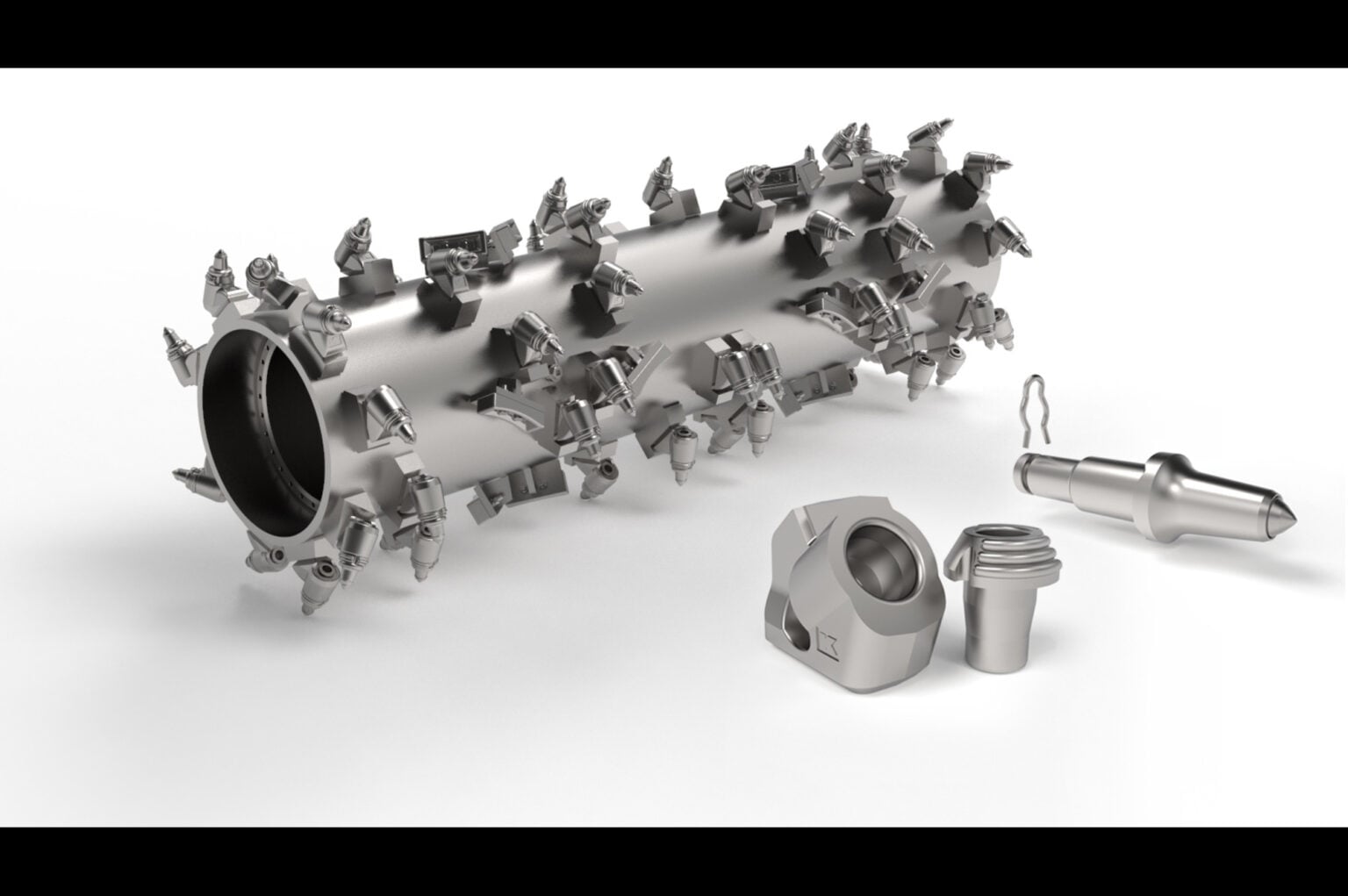

The transition burden of shifting from internal combustion engine (ICE) platforms to electrified ones involves high capex, workforce training, and new supply lines (especially batteries/battery components), all of which will weigh on margins and supplier contracts.

For suppliers specifically, this means fewer overall units built, more variability in model mix (which makes forecasting harder), more pressure on cost-competitiveness, and a need to pivot towards new technologies (EV components, software, battery systems and hybrids) if they’re going to stay in the game.

Key challenges for suppliers

The volume decline means much greater order pressure. With lower vehicle production, demand for specific legacy components will shrink. Tier-1 and Tier-2 suppliers providing traditional ICE parts are feeling this keenly.

The ongoing model transition turbulence sees assemblers retooling, changing platforms, and sometimes temporarily pausing production or shifting capacity, while looking for hybrids given the slower-than-expected take-up of pure EVs. That creates lumpy demand for parts from suppliers, with spikes and then drops, which complicates planning.

On the flip side, components for hybrids, electrified powertrains, battery systems, high-voltage wiring, software and electronics integration are more in demand. Suppliers that can reposition into these areas can secure future business.

And while output is down in 2025, the share of electrified vehicles (hybrid, plug-in hybrid, full battery-electric) is rising. In the first half of 2025, electrified vehicles across all categories accounted for over 40% of UK car production (160,107 units), up from earlier years. This increases opportunities for suppliers that specialise in EV drivetrains, battery modules, power electronics, wiring harnesses for high-voltage and so on.

Automotive summary for 2026

The automotive crisis is caused by weaker volumes, rising costs, trade and regulatory headwinds. For suppliers, it is a hugely demanding environment. But it is not a hopeless one. The transition to electrified vehicles and continuing export flows mean that there are real opportunities for those suppliers willing to adapt.

In the short term, that means doubling down on electrified component capabilities, sharpening cost competitiveness, broadening the customer base, and closely monitoring government policy and trade developments. The market may be down this year, but the foundations for the future shape of the industry are being laid now.

Read more about the outlook for automotive and EV transition in David Bailey’s online blog. https://ukandeu.ac.uk/