Aviation is on the up despite titanium-tough conditions

The return of wide body aircraft, growth in business jets, expected higher defence spending and a big sustainability drive including hydrogen propulsion. These are some of the trends shaping the recovery of aerospace manufacturing through 2022 and into 2023. Will Stirling reports.

Making components for aircraft demands resilience: the months of work required to pass rigorous accreditation is not for the jobbing manufacturer. After some very good years, suppliers to the aerospace primes had to dig deep in 2020 and 2021 as orders nosedived. So, 2022 was a recovery year despite some headline bumps, like Rolls-Royce’s falling share price (it has rallied since mid-October and broke the £1 mark on 4 January), and the forecast is good. The year’s end was strong for aircraft deliveries, with 92 single aisle aircraft and 24 widebodies delivered globally to customers in November, as the industry continues to recover from the slump of 2020 and 2021. A successful December marked 1,000 deliveries in 2022 for the first time in three years, a year that saw the fastest pace of orders since 2015. The collapse in wide body aircraft (WBAs) during Covid punished the industry, but these bigger aircraft are returning.

In December, United Airlines placed an order for 100 new 787 Dreamliners with options to add 100 more – the biggest WBA order by a US carrier in commercial aviation history. Flying hours for large engine aircraft continued to increase across 2022, good news for Derby-headquartered Rolls-Royce, although these are still below pre-pandemic 2019 levels. A low pound valuation, touted as a blessing for UK exporters, is less helpful for companies with international operations. Here some aerospace companies tell MTD what’s happening and their expectations for 2023. Fortunes have differed across regions and business segments. “The Midlands was badly affected by the pandemic because there is a lot of dependence on the large, long distance aircraft like the 787 and A350, through Rolls-Royce but also through other customers, who were worst affected by the pandemic and are the ones that are still slowest to recover,” says Dr Andrew Mair, CEO of the Midlands Aerospace Alliance. “The Midlands is recovering more slowly than some other regions, just as it benefited more than other regions in the boom around 2015.” “For 2022 highlights, the Airbus single aisle 320 family is still ramping up as Airbus tries to take market share from Boeing. Business jets were, possibly unexpectedly, very positive. During the pandemic, those who could afford them were using business jets for health and safety reasons. Defence hasn’t changed, it has been steady all the way through. A boost related to the Ukraine War is potentially going to come. Diversification was a theme in the last three years, as companies sought new business outside aerospace.

It’s much easier to switch out of the tightly regulated aerospace work into general manufacturing, than the reverse.” Aerospace is such a long term game that big programmes ride out downturns and, often, recessions. Several prime companies are invested in Airbus’ Wing of Tomorrow (WoT) technology programme, where GKN’s new £32m Global Technology Centre in Bristol is a key partner. Wing of Tomorrow captures wing design, materials, manufacturing methods and even propulsion systems designed to reduce the carbon emissions of flying. GKN’s H2GEAR programme has recently reported good news. After its first round of system level trade studies into hydrogen fuel systems, showed that GKN’s developments in the fuel cell system integration, combined with hyperconducting power network and motor drive systems, will enable hydrogen electric propulsion to be scaled up more quickly than was originally expected.

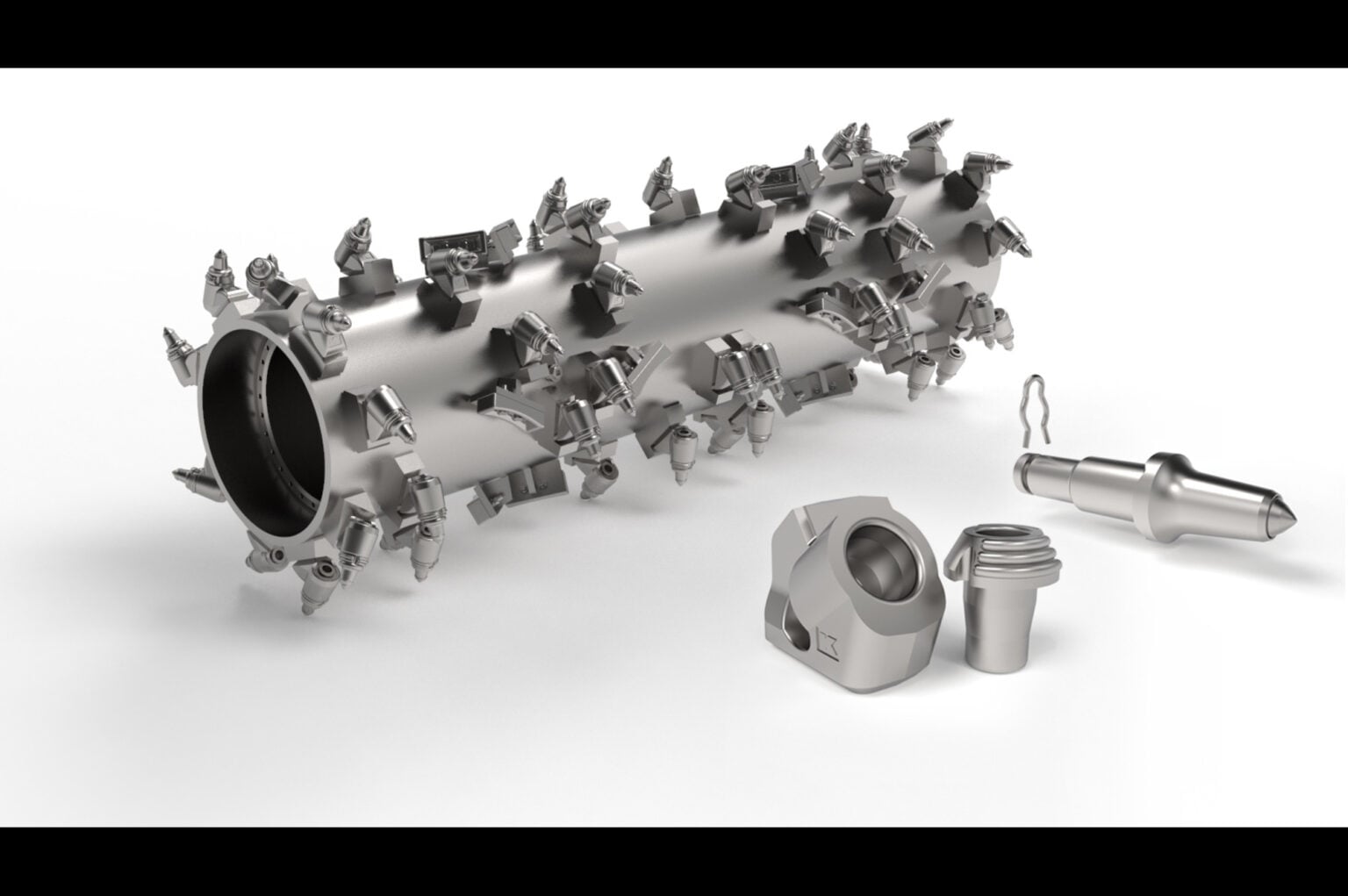

JJ Churchill in Market Bosworth changed considerably through the pandemic. Despite huge order books, when the nearly debt-free family business needed a credit facility for working capital, the bank said no, and that “aerospace and aviation were ‘too risky’”. It is now majority-owned by a US private equity company that understands the order book and the risk profile. JJ Churchill specialises in manufacturing blades for gas-turbines and is strongly vertically integrated.

About 90% of the business is focused on aerospace and, specifically, high value turbine blades which are more technically demanding. It still supplies compressor blades, including most recently for the Rolls-Royce Ultrafan development project. As wide-body civil aerospace orders slumped, the 84 year-old company switched to business jets – a segment less impacted by the pandemic. “Private jet travel grew as Covid required social distancing and commercial flight options for higher net worth customers reduced,” says Executive Chairman Andrew Churchill. The company now supplies blades to engines for the Bombardier 6500 and Gulfstream 700 as well as the soon to be launched Gulfstream 800 and Dassault’s Falcon 10X business jet. The 10X is the first time the French-owned Dassault has used a Rolls-Royce engine platform, from their ‘Pearl’ family, in its history. “It has a been a tough time and, despite a £150m order from our biggest customer, the banks pulled their support – even though we hadn’t borrowed beyond standard asset finance for 15-years,” says Andrew. “I never thought we’d be PE-owned, but we now have a committed partner, a third of a £1 billion order book, a strong year ahead and a strategy to become a serious mid-cap company in the next five years. C’est la vie.”

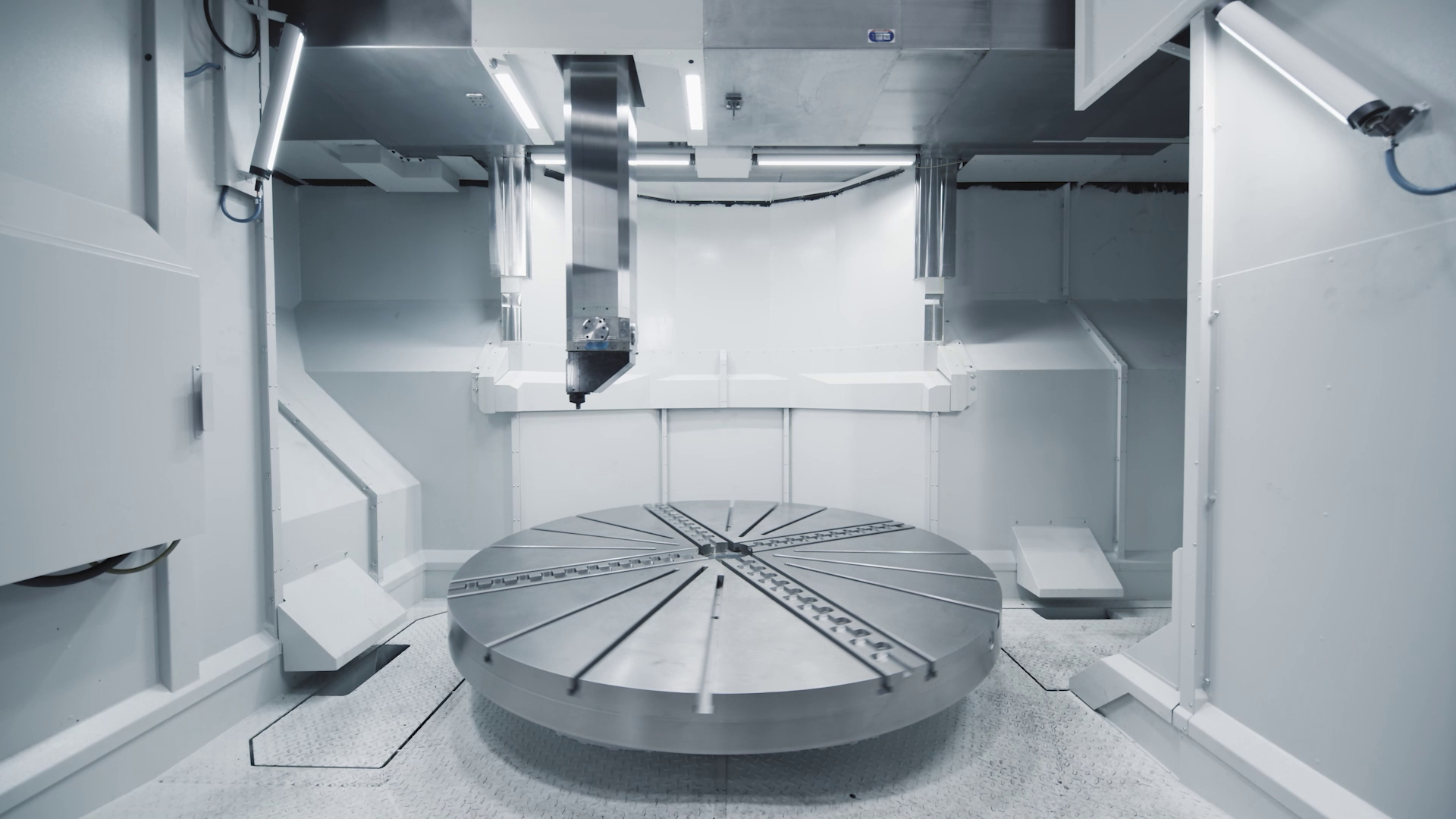

The fortunes of aerospace can be reflected by sales of machinery popular in that sector. NCMT distributes and supports precision engineering companies with Okuma and Makino machine tools in the UK and was founded in 1964. The business is positive about this year. “Our perspective is that the aerospace sector has started to boom again,” says NCMT’s Sales Director, Ian Horton. “There has been a massive upturn in enquiries over the past five months and machine sales over the last two months have been as robust as in 2018 and 2019, which were very good years. Business is spread evenly across airframe and engine component manufacture, large and small machine tools, both for the Makino and Okuma, both Japanese brands. Coincidentally, two very large orders were received the day these words were written (late December).

VIPER grinding of blades and vanes on the Makino machine platform is also coming back strongly,” Ian adds. Sylatech is a multi-discipline business in North Yorkshire specialising in investment casting, RF microwave technology and CNC machining. It has been involved in the ‘Sharing in Growth’ programme that assists SME precision engineering firms to qualify for new contracts and grow. About 80% of the business is in aerospace and defence and space, and the company recently decided to define a STRATEGY focusing on aerospace, defence and space and communicate its strategy to the workforce. “Civil aerospace in 2022 bounced back very strongly, we are looking at about 20% growth in 2022 and it’s possibly slightly stronger than pre-pandemic,” says Commercial Director Gordon Gunn. “Much of what we make goes into all sizes of aircraft, including parts fitted into the weather radar, within the aircraft nose cone. We also make static dischargers, so we have versatility.”

VIPER grinding of blades and vanes on the Makino machine platform is also coming back strongly,” Ian adds. Sylatech is a multi-discipline business in North Yorkshire specialising in investment casting, RF microwave technology and CNC machining. It has been involved in the ‘Sharing in Growth’ programme that assists SME precision engineering firms to qualify for new contracts and grow. About 80% of the business is in aerospace and defence and space, and the company recently decided to define a STRATEGY focusing on aerospace, defence and space and communicate its strategy to the workforce. “Civil aerospace in 2022 bounced back very strongly, we are looking at about 20% growth in 2022 and it’s possibly slightly stronger than pre-pandemic,” says Commercial Director Gordon Gunn. “Much of what we make goes into all sizes of aircraft, including parts fitted into the weather radar, within the aircraft nose cone. We also make static dischargers, so we have versatility.”