Maximize Your Section 179 Savings with Okuma CNC Machines and Automation

The U.S. Section 179 tax incentive offers manufacturers an outstanding opportunity to invest in new equipment while significantly reducing taxable income. It’s designed to encourage businesses to reinvest in their operations — and there’s no better way to do that than by upgrading your production capabilities with Okuma CNC machine tools and automation solutions.

By leveraging Section 179, companies can deduct the full purchase price of qualifying machinery and equipment purchased or financed during the tax year (subject to current limits). That means your investment in new technology not only boosts productivity and quality — it can also deliver immediate financial savings.

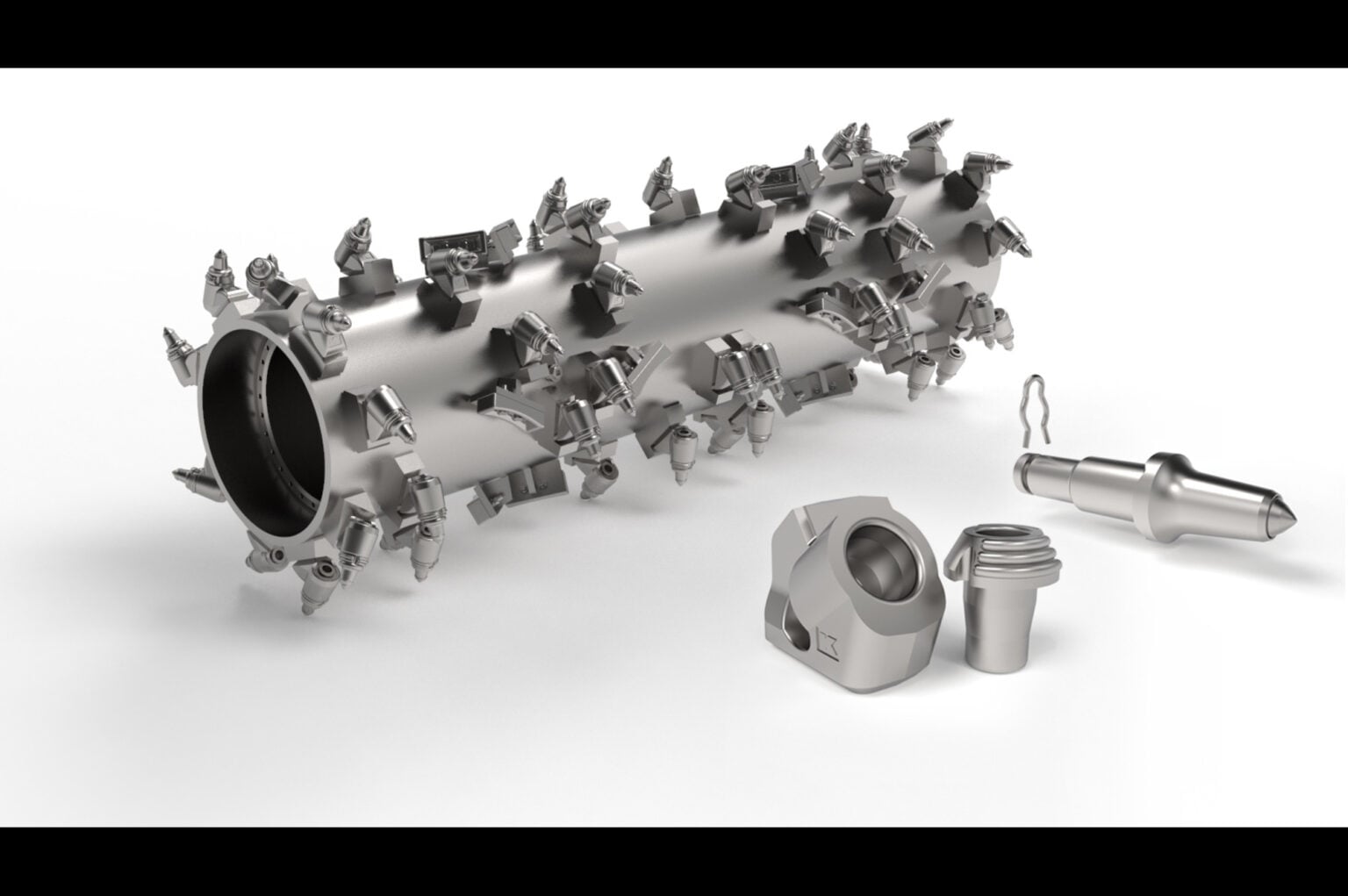

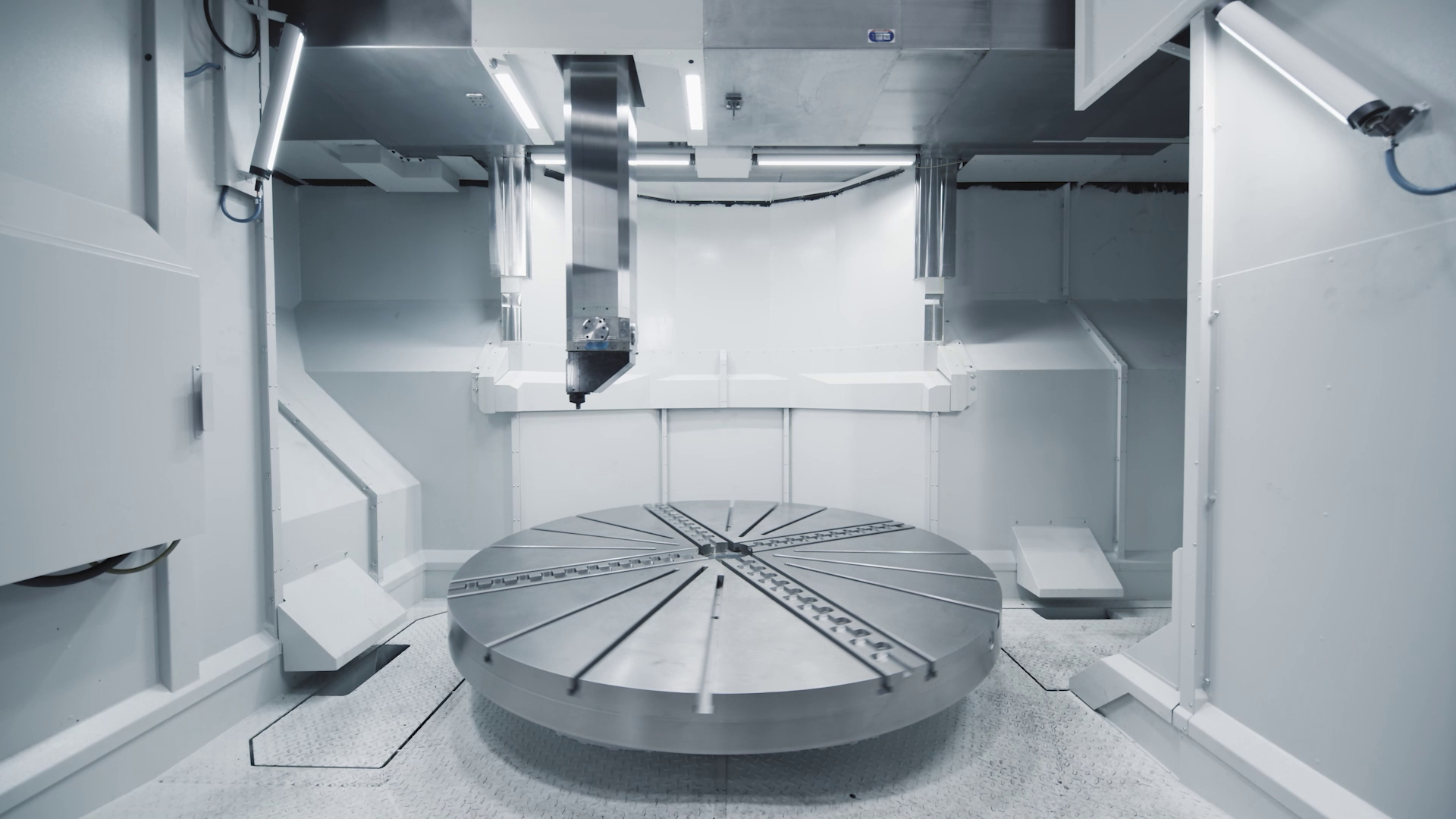

At Okuma America, we understand that every shop’s needs are unique. Whether you’re looking to expand capacity, enhance precision, or add lights-out automation, our wide range of CNC lathes, machining centers, and integrated automation systems can help you:

- Modernize your production with advanced control technology

- Improve efficiency and throughput across all operations

- Reduce downtime through intelligent monitoring and reliability

- Strengthen your bottom line with both performance and tax savings

Now is the perfect time to take advantage of this incentive and position your shop for growth in 2026 and beyond.