🎧Funding to accelerate the low-carbon switch

While car production is slow, factory activity is building strongly to decarbonise automotive as carmakers target 2030 for going all-electric. Subcontractors could be eligible for the new DRIVE35 government programme, which could offer some companies grant funding to help them lighten and decarbonise their products, says Will Stirling.

Based on cold numbers, little has changed in the automotive sector since MTD’s last report in March. In 2024, UK vehicle production was at its lowest level since 1954, excluding the disruption from Covid. And in the first half of this year, carmakers posted another 12% drop to just 417,200 vehicles manufactured, the lowest number since the early 1950s. The causes are well-known: weak global demand and the cost of the transition to low-carbon vehicles.

But SMMT, the motor industry business group, is forecasting a bounce back in 2026 and there is evidence from several quarters that they are right. First, note that what we see on the roads is not an accurate reflection of changes happening in the factories of Britain. Only 4.75% of the 34 million cars on UK roads are fully electric, rising about one per cent a year, according to EV consultancy Zapmap. For new sales, by July 254,666 new fully electric cars had been sold, a 21.5% market share of all new cars registered this year and 57,745 more fully electric cars than were sold at the same point last year. The proportion of new electric cars has grown from 11.6% in 2021, to 19.6% in 2024 – so, decent if unspectacular progress, reflecting buyers’ reticence with cost, and charge point/range anxiety.

A new EV grant and falling prices could boost sales. Many buyers lacked incentives until now. Lower-cost EVs from Renault and Chinese brands, along with a £3,750 Electric Car Grant and EV Chargepoint Grant, might increase sales,” says Professor David Greenwood. However, the full grant applies only to cars with the lowest CO2 footprint; others receive a reduced £1,500 discount. Currently, no UK-made or sold cars qualify for the full grant, experts at BBC Top Gear say.

Manufacturing activity is different to cars on the road, however. In the UK, about 80% of what we buy is imported and 80% of what we make is exported, and there are some very different drivers at play affecting manufacturing. Across the board, EV and low carbon vehicles and their component makers are ramping up fast.

Jaguar Land Rover recently stopped making the XE, XF, and F-Type models as it shifts to an all-electric ‘reimagine’ brand, reducing production at Jaguar sites temporarily. However, this should be offset by Nissan increasing output in Sunderland, including new models like Qashqai, EV Leaf, and Juke, despite closures elsewhere. Overall, manufacturing volumes are expected to rise later this year, with Nissan among several automakers investing in factory expansions.

Factory and product investments pick up UK Export Finance has underwritten a £1bn export development guarantee to Ford UK, aimed at supporting Ford’s global transition to EV production. The loan, provided by Citi and several lenders, helps fund aspects of its transformation to EV powertrains, and it follows a £380m investment in its Halewood manufacturing plant, to switch from producing transmissions to electric motors.

Steel frames have been erected at the site of Agratas’s new battery gigafactory in Somerset, marking the start of the next phase, the vertical build. 17,000 piles had been placed in the ground by the end of June. Agratas says that 100% of the steel used for the build is sourced from British suppliers.

Astemo UK, a subsidiary of Japanese car parts maker Astemo, will build a new production line for inverters for next-generation EVs at its Bolton plant. The total investment, which includes support from government’s Automotive Transformation Fund, is £100 million and it will secure an estimated 220 jobs. Production is scheduled to begin in April 2027.

Rolls-Royce will be fully electric by 2030, starting with the Spectre coupé, followed by an electric SUV in 2027 and a new luxury saloon replacing the Phantom. They are building a £300m extension to the Goodwood factory to increase capacity and support electric vehicle manufacturing, investing in future demand.

The government launched DRIVE35, a long-term £2.5bn programme supporting low-carbon vehicles. It includes £2bn in funding to 2030 and £500m for R&D to 2035, a ten-year commitment to UK automotive innovation.

Here’s the good bit: subcontract manufacturers that make car parts and are focused on lightweighting are ineligible for DRIVE35 funding. Three main funding priorities are: supporting innovation, accelerating start-up and enabling transformation – so if a company’s work fits broadly into any of those categories, it has a chance of winning an award.

How are SME metal forming companies responding on the ground?

“Full electric transition is still way off, but a lot of our members have already started to adapt what they do to supply into the new generation of vehicles – many of them with significant success,” added Stephen Morley, President of the Confederation of British Metalforming.

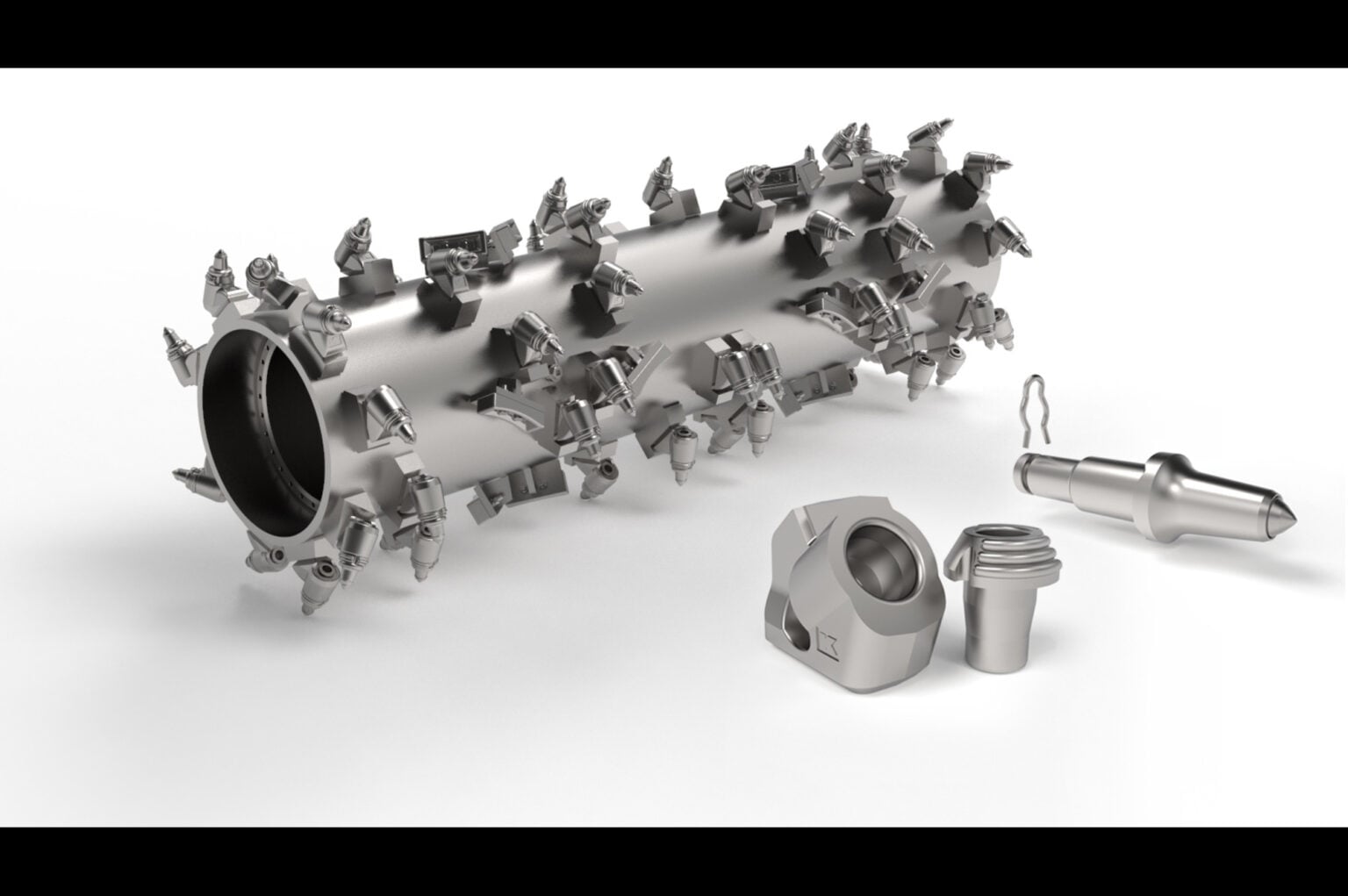

His organisation represents more than 200 companies involved in fasteners, forgings, pressings and precision metalwork, a vital part of the industry that makes products that go into many critical automotive applications.

“There are many opportunities and UK firms are renowned for their resilience and ability to pivot to make the most of them. But Steve adds “I’m afraid there is a big ‘but’ though.”

“We are achieving all of this despite a tsunami of external factors out of our control, some of which are self-inflicted by a government that is supposed to be backing industry. The change in steel safeguarding quotas – introduced at the drop of a hat by Business Secretary Jonathan Reynolds in July – was against Trade Remedies Authority (TRA) and has caused major disruption and financial hits to our sector. Our members have reacted furiously to this decision.”

While the ambition is grand, regulations that hamper SME efficiency and the disconnect between government and business pervades and risks slowing any recovery as the electric shift beds in.

Expect car production to rise in 2026

While the numbers and order books today are low, for many, there are legitimately brighter days ahead for the car industry. The UK has a beneficial tariff rate (relative to the EU) for exporting cars to the US of 10%, but this applies only to the first 100,000 vehicles imported into the US. Beyond 100,000, the higher tariff of 27.5% applies; however, it’s still a relative boost for UK-made luxury brands.

Prof Dave Greenwood adds, “The measures announced for the automotive sector in the industrial strategy (that include reduced energy costs, R&D grants, Investment Zones, etc) should all position well for longer-term future growth in manufacturing.”