Samvardhana Motherson Expands Aerospace and Ventures into Semiconductor Supply Chain!

By Ashutosh Arora

Samvardhana Motherson International Ltd (SAMIL), a major player in the automotive sector, has significantly expanded its aerospace business and is now making strategic inroads into the semiconductor supply chain market. The company has grown its aerospace division fivefold within a year and is now a Tier-1 supplier to Airbus, marking a significant milestone in its diversification strategy.

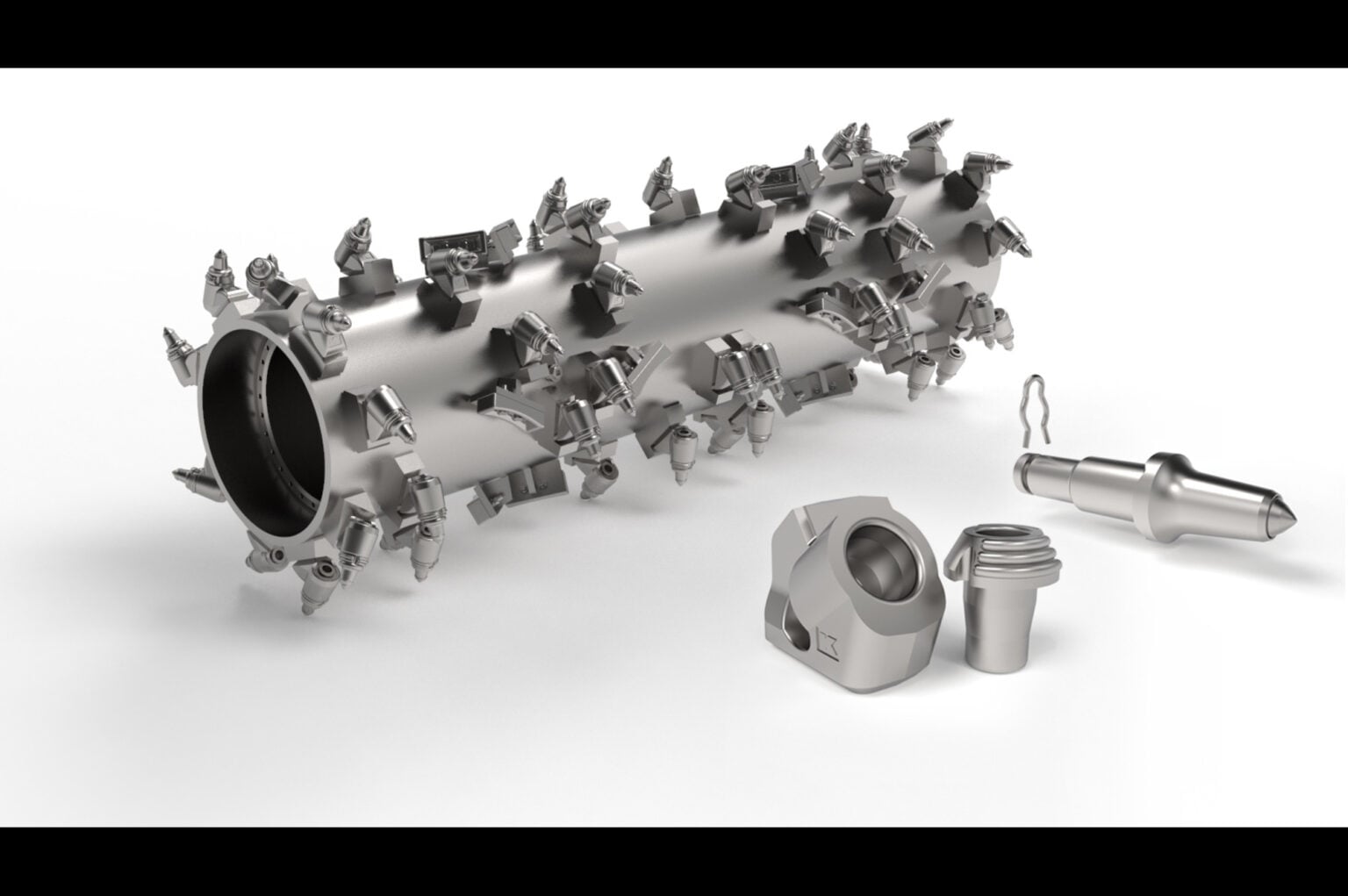

In the past year, Samvardhana Motherson’s aerospace revenue surged from Rs 339 crore to Rs 1,749 crore in FY25. The company has established itself as a key player in the aerospace industry, working with major aircraft models such as the A320, B737, and the entire LEAP engine family. With an order book valued at approximately US$1.2 billion for the next five years, Samvardhana Motherson is solidifying its presence in the aerospace sector, demonstrating substantial growth potential outside its automotive roots.

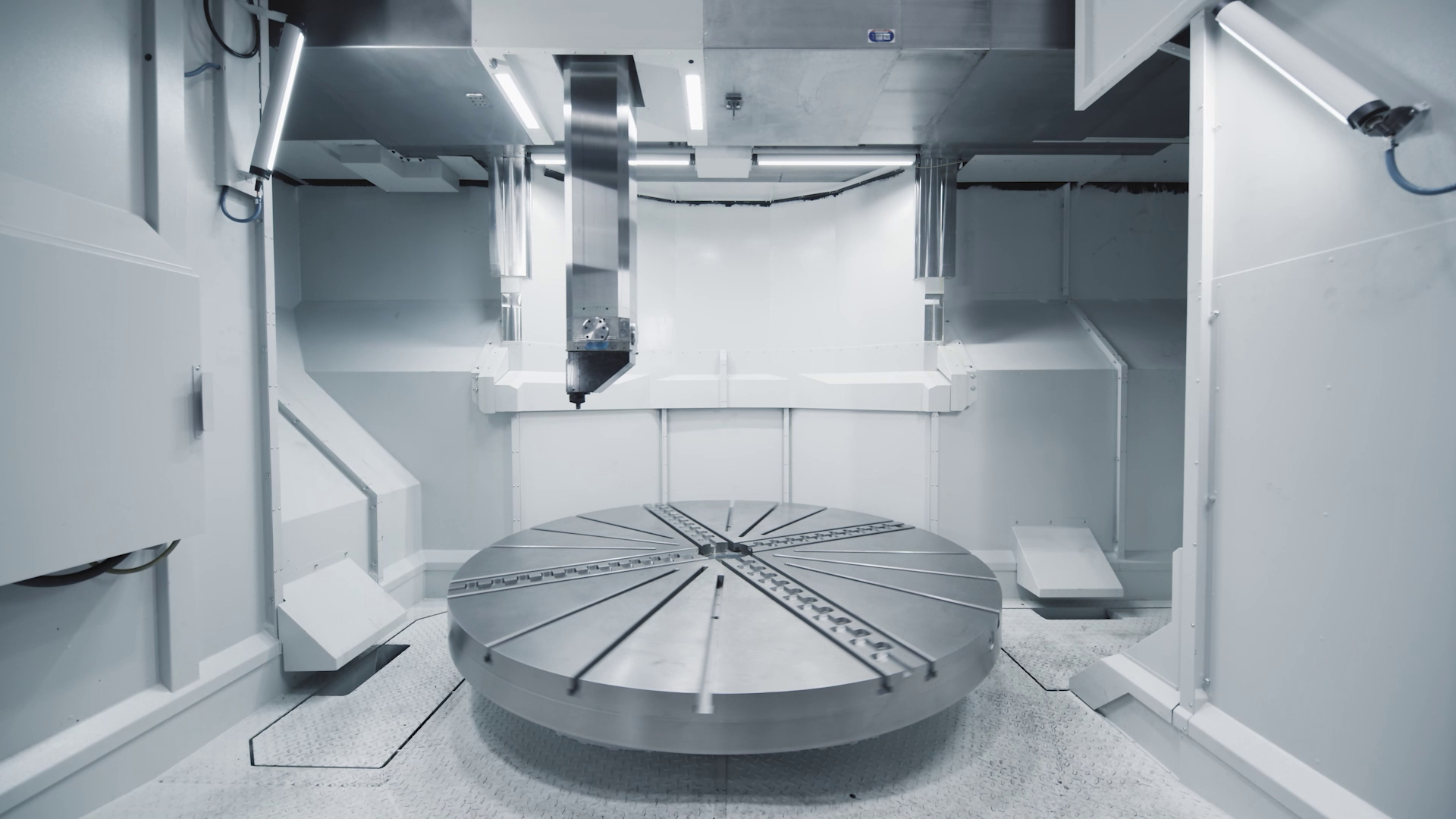

As part of its expansion strategy, Samvardhana Motherson is venturing into the semiconductor industry by setting up a new greenfield project aimed at supplying components for semiconductor manufacturing equipment, essential for producing silicon wafers. This new facility, building on the company’s aerospace expertise, will not only support the semiconductor industry but also cater to the electronics and advanced manufacturing sectors in the future. According to Vaman Sehgal, Deputy CEO of SAMIL, “We are setting up a new greenfield to supply components for equipment used to manufacture silicon wafers.”

This new venture into the semiconductor supply chain reflects SAMIL’s broader strategy to diversify its operations beyond automotive, expanding into sectors like consumer electronics and defence. The aerospace division, which has laid a strong foundation, is being leveraged to pivot into other high-tech industries, reducing market cyclicality and positioning the company for sustainable growth across various sectors.

For FY26, Samvardhana Motherson plans a capital expenditure of Rs 6,000 crore, with 70% of the investment directed toward non-automotive growth. This strategic allocation underscores the company’s commitment to expanding its footprint in cutting-edge industries such as aerospace, semiconductors, and electronics, setting the stage for future growth and diversification.